Stocks are set to close on a great 2019. Year to date, global stocks are up well over 20%. US stocks have led and are making new all-time highs along the way. Fed Chair Powell has suggested no more rate hikes in 2020 and President Trump announced a "phase one" agreement in the US-China trade … Continue reading Full Circle

Category: investing

Burning Out

Bulls running high Markets exhaled a sigh of relief following the US-China trade truce and US stocks are retesting all-time highs. Like I wrote earlier this year, the new-highs are not a surprise and there could be even more upside if Chairman Powell delivers on anticipated rate cuts. Ironically, these new highs could signal a topping … Continue reading Burning Out

Paint, Grass, and Data

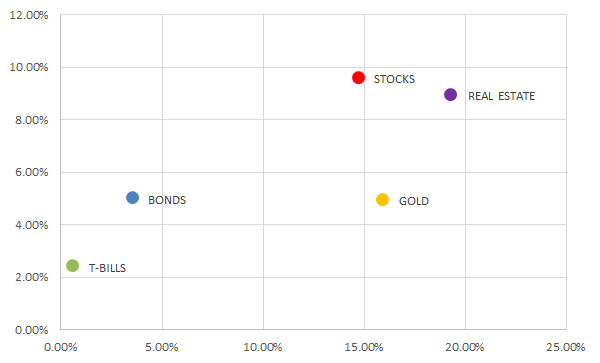

"Investing should be more like watching paint dry or grass grow. If you want excitement take $800 and take it to Las Vegas " - Paul Samuelson. Spoken like the Nobel Laureate he was, Dr. Samuelson's simple, timeless words of wisdom resound true until this day. Long-term investors should focus on fundamental data rather than … Continue reading Paint, Grass, and Data

Much Ado About Something

The last two months have been choppy for stocks. The S&P 500 is down about 8% and has given up its gain for the year. Emerging markets have outperformed since October, relatively speaking, but remain the biggest loser YTD, down about 16%. As usual, the financial media is searching, desperately, for something to fear. Does … Continue reading Much Ado About Something

Patience and Profits

Volatility returns Stock market volatility is back. In February this year, the S&P 500 posted the largest single-day point fall in its history, only to rebound with the fourth largest single-day rise in history. All that volatility has some questioning if it still makes sense to invest in the stock market. S&P 500 BEST & WORST SINGLE DAY POINT … Continue reading Patience and Profits

Greed and Fear

US stocks are at all-time highs and many valuations measures suggest they are expensive. That doesn't mean the market can't keep rising and it's proven bears wrong for years. However, it's fair to say US stocks don't look cheap by traditional standards. It's actually getting hard to find any market that looks like a compelling … Continue reading Greed and Fear

No Market for Old Men

US stocks are in one of the longest bull markets in history. Many are warning of extended market valuations. Two of the most highly regarded valuation measures seem to agree. The chart below shows Dr. Robert Shiller's CAPE ratio has reached levels surpassed only by the dot-com bubble peak in 2000. CAPE Ratio Source: Multpl … Continue reading No Market for Old Men

Bitcoin, Blockchain, and a Bag of Chips

Cryptocurrencies like Bitcoin are the dish du jour. Everyone from seasoned investment managers to teen-aged kids wants a taste of the crypto. There's a good reason too, Bitcoin is up almost 300% in the past year alone. But price swings are extreme, enough to make even veteran traders squirm (both in pain and delight). The … Continue reading Bitcoin, Blockchain, and a Bag of Chips

Picking Cherries

In the previous post, I made the point that US stock market valuation isn't as high as a cursory glance at traditional P/E measures might imply. Adjusted for inflation, valuations actually look more "median" than anything. But I also don't think US market valuations are currently attractive. And some of the arguments I've seen about … Continue reading Picking Cherries

Fitting the Earnings Shoe

The first quarter started with a bang but ended with a thud. The US stock market was basically flat and the bond market was modestly up. The widespread global recession rhetoric seems to be quieting. This is particularly true in the US where we have been pointing out economic conditions are not as bad as … Continue reading Fitting the Earnings Shoe

Halfway Between Double or Nothing

The official numbers aren't in yet but it looks like 2015 ended without a bang for US markets. The S&P 500 managed somewhere around 1% total return and the Barclay's Aggregate ended up about .5% -- nothing worth getting excited over. Of course, across the globe and everywhere in between there were substantial divergences in … Continue reading Halfway Between Double or Nothing

Full Swing Voting

Following a choppy third quarter, global markets have made a comeback. Since October 1, the S&P 500 and EAFE have both rebounded over 5%, and emerging markets have bounced by more than 8%. Strangely enough, the same fears that stoked the sell-off also seem to be fueling the rally. Investors who disliked the uncertainty … Continue reading Full Swing Voting

You must be logged in to post a comment.