U.S. economic and market conditions turned on a dime more than once over the past year. Conditions went from “exceptional” in Q4 2024 to the brink of recession by Q2 2025, only to bounce back to business as usual by the end of the same quarter.

The U.S. stock market has been a good reflection of the flux. Although it is up for the year, it has done so with wild swings that included an intra-quarter bear market. That volatility reflects uncertainty and anxiety amongst investors.

When investors don’t know what to expect, they get anxious and can overreact to surprises. The market volatility is nothing new, but the increased volatility in economic data is something different.

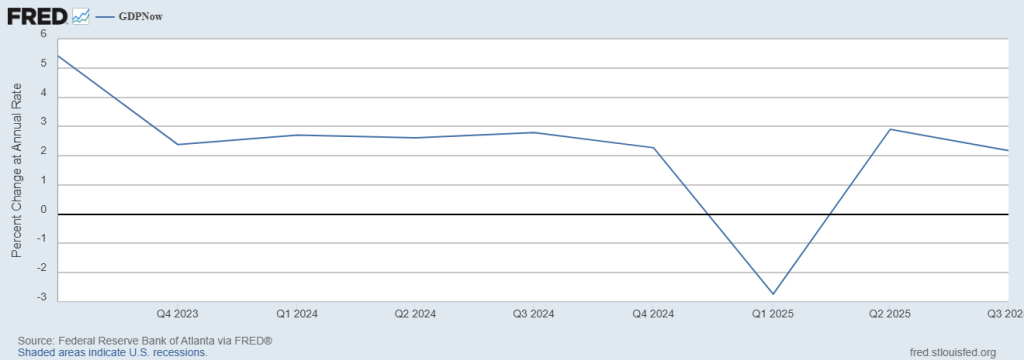

For example, GDP went negative in Q1 2025 but quickly swung back to positive by Q2.

GDP Growth

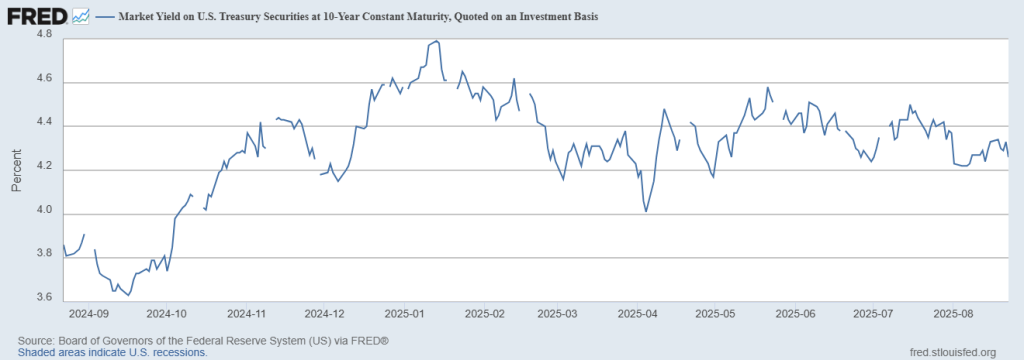

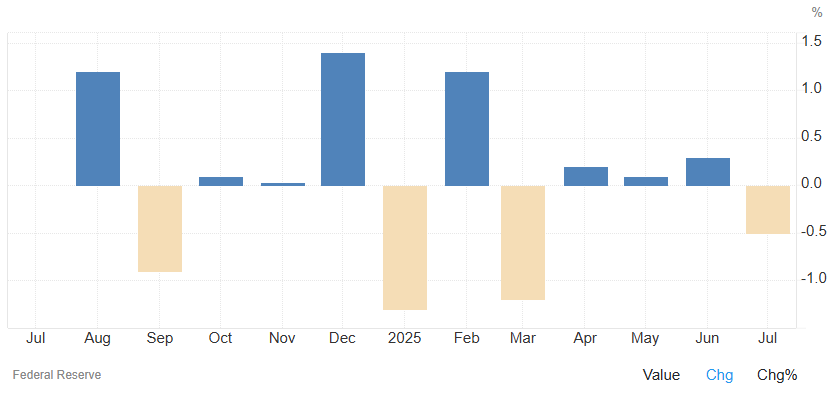

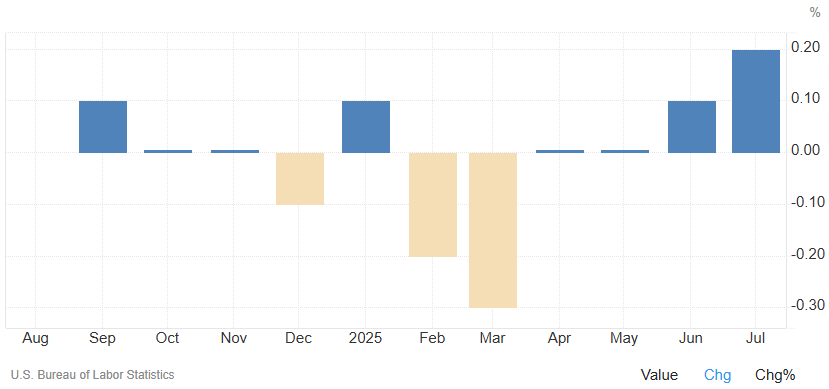

Meanwhile, 10-Year Treasury Yields, data on production, inflation, and others have all bounced back and forth between worrisome and constructive all year long.

10 Yr Treasury Yield

Industrial Production

Core Inflation

That poses a curious challenge. Normally, when markets are buzzing with uncertainty and speculation, investors can focus on fundamental data to filter the signal from the noise. However, even the signal is noisy right now.

That’s because the drivers of those signals are also facing unprecedented uncertainties. For example, the swings in GDP this year have not been accurate representations of natural supply and demand.

Instead, they reflect panicked reactions from consumers and businesses trying to avoid tariffs which, surprise, surprise, were different from expectations several times over. Imagine the chaos that causes for everything from inventory and supply chains, to production and investments. Should we hire, fire, buy, sell? Who knows!

The result is we do not have a clear read on actual economic conditions or activity that is untainted by policy surprises and knee-jerk reactions. That should improve into year-end after the economy, markets, and investors settle into their new respective cadences.

And of course, that also assumes no more surprises, which may be wishful thinking in the current environment. It’s hard enough trying to read the economic tea leaves, spiking the pot does not help. Drunken tea leaves or not, our current observations continue to reinforce our cautious position and modest underweight of risk assets.

—

Victor K. Lai, CFA

You must be logged in to post a comment.