It’s been a fast moving year for the markets and solidly positive overall. Yet, despite wide swings in both directions, markets ended the quarter close to where they were back in February. Year-to-date, global stock prices are up +9.7%. US bond prices are up +2.4%. Gold continues to lead, up +24.1% YTD.

Global Markets

MACRO VIEW

The second quarter experienced several macro surprises. The most noteworthy included President Trump’s “Liberation Day” tariffs, escalating military conflicts, and rising long-term Treasury yields.

Investors seem unanimous that tariffs are bad for markets. They seem indifferent about war, or possibly just numb. And they seem confused about rising Treasury yields because the changes are being interpreted differently

A glass-half-full perspective thinks rising long-term yields reflect rising US growth expectations. It reflects the President’s “America-first” policies, the re-shoring of jobs, and a made in America renaissance.

A glass-half-empty perspective thinks the rising long-term yields reflect rising inflation expectations from tariffs and trade wars. It also reflects a loss of confidence in the US dollar and America’s financial strength.

Arguments can be made both ways, but a couple of observations suggest the glass may be inching lower.

First, the Treasury Yield Curve is still bouncing near inversion territory. The 3-Month Treasury Yield ended Q2 higher than the 10-year. If we want to say Treasury yields reflect growth, then an inverted Yield Curve means short-term growth expectations are higher than long-term. That implies growth will decrease, not increase.

Second, in May, global credit agency Moody’s Ratings downgraded the US’s credit, citing America’s inability to curtail debts and deficits. The rating change was mostly symbolic (from Aaa to Aa1), but it reinforced the view that rising yields (as well as a weakening US Dollar) reflect fading confidence in America’s financial strength.

However, that wasn’t the first time US government credit was downgraded. Other rating agencies like Fitch and S&P began doing so as far back as 2011. Yet, the US economy and Treasury debt market continued to perform exceptionally well.

So, even if the world is losing confidence in the US and drifting towards de-dollarization, the journey will not be short. Half-empty or not, there could still be a long runway before these slippery issues run dry.

Meanwhile, current economic conditions are back to being relatively benign, for now. The recession scare in April was predominantly based on the shock of Liberation Day tariffs, and fears of the worst case scenario. But after the tariff pauses, exemptions, and walk back in rhetoric, the worst case seems to be off the table.

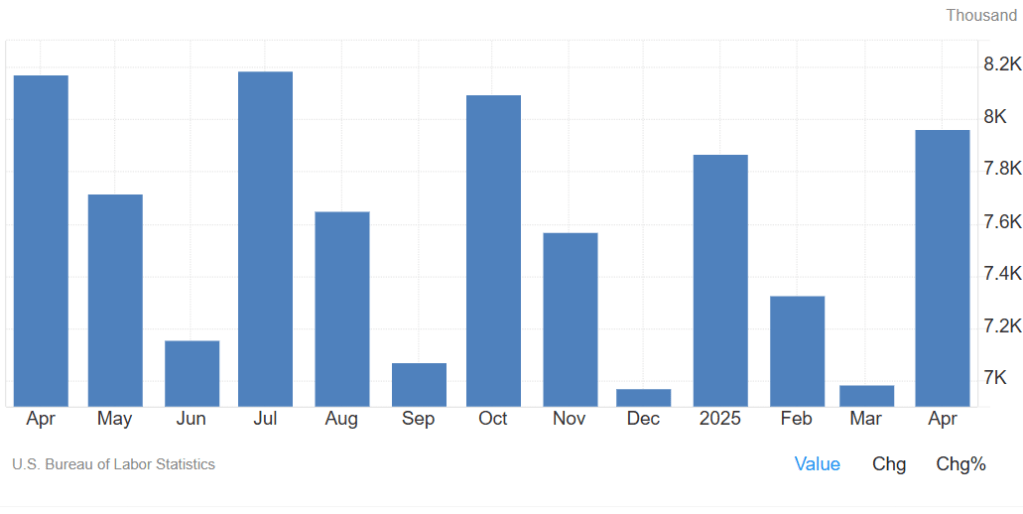

Absent that shock, we’re back to where we were in Q1. Credit spreads remain narrow and corporate profits remain positive (albeit slowing). More importantly, employment, income, and consumption remain resilient.

Job Openings

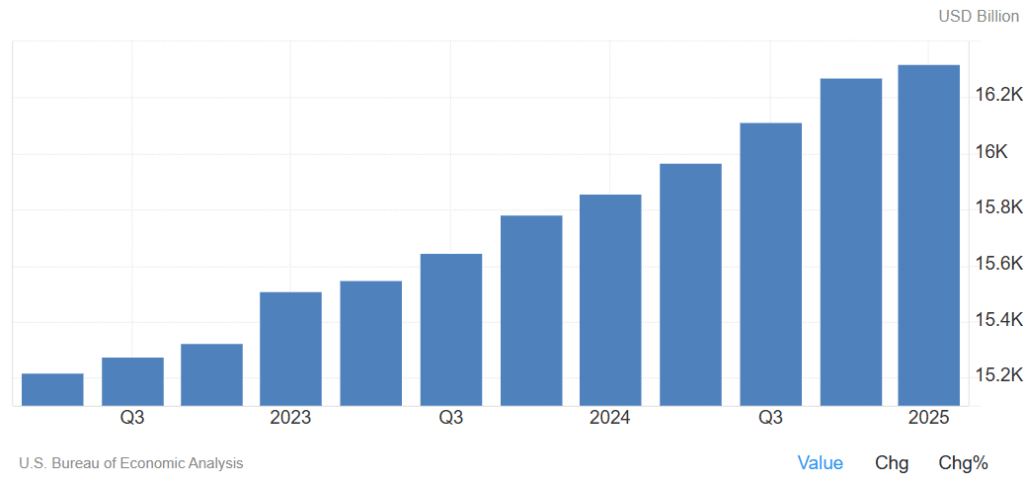

Wages

Consumer Spending

Yes, macro risks still exist and there are still concerns. For example, Q1 GDP did come in negative. However, it was better than feared. Also, the contraction was clearly explained (and anticipated) by a spike in imports ahead of tariffs.

All things considered, there are no alarming indicators of an imminent recession at present, and economic conditions are back to looking relatively benign.

MARKET VIEW

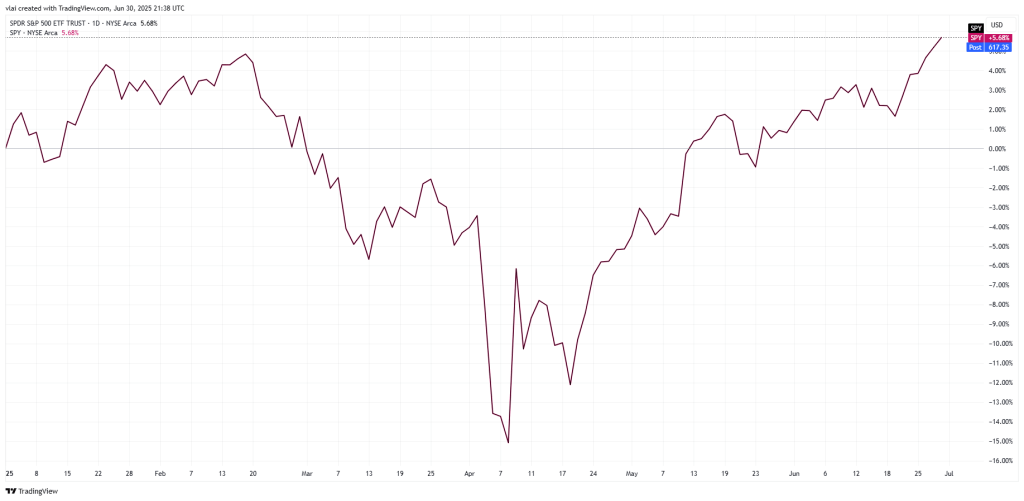

Financial market action reinforced that tariffs were the main story in Q2. Following Liberation Day tariff announcements, the S&P 500 quickly breached the -20% downside threshold for a bear market.

S&P 500

Stocks also quickly rebounded and closely followed President Trump’s announcements on tariff pauses and trade deals. Meanwhile, markets seemed to brush aside other macro concerns like rising military conflict, showing a singular focus on tariffs.

With that in mind, the current pause on Liberation Day tariffs is set to expire on July 8, 2025 (ex-China, which extends until August). That presents an obvious risk for another market drawdown should the tariffs come back as scheduled.

Fortunately, the current administration recognizes the market’s sensitivity to tariffs, and it unlikely wants a repeat of April’s panic. From that perspective, it’s also unlikely maximum tariffs will be simply switched back on at midnight July 9th.

The more likely outcome is an extension of the current pauses, or possibly a slow and steady schedule of increases, allowing time for adjustments and announcements of new deals.

To be clear, any tariff increases may be taken negatively. However, what investors really fear is the worst case scenario. So, despite the scary headlines, outcomes that are better than expected, or just less bad than feared, can be enough to continue the market’s upward momentum.

INVESTMENT VIEW

Again, after the worst case scenario was avoided in April, the outlook for market and economic conditions are back to how they looked in Q1. Relatively weaker than year-end 2024, but still relatively benign overall, without obvious warning signs of an imminent recession.

As such, we adjusted the risk exposures in our Macro Allocation (MA) strategy in June. Specifically, we tactically increased our allocation of risk assets upward, closer to their strategic targets. That places our current MA risk exposure at a modest underweight, which is back to the same position as in March, before the tariff induced sell-offs.

We remain at a modest underweight (not at strategic target weight) for the same reasons as before. Again, although we don’t see signs of an imminent recession, conditions look worse now than they were at year-end 2024, particularly with the “10% baseline tariffs.”

Furthermore, the combination of potentially higher tariffs ahead, a highly-volatile geopolitical climate, and elevated equity market valuations do not present ideal conditions for a substantial increase in risk exposure.

All that being said, we recognize and respect what we’ve experienced this year. Conditions, sentiment, and momentum can change on a moment’s notice or a social media post. That means we must stay vigilant of changing circumstances, remain flexible, and be ready to adjust as changes occur. We will continue doing so and will keep you updated on what we see.

—

Victor K. Lai, CFA

You must be logged in to post a comment.