What a difference a day makes. Just one day after BCM’s Q2 Update, we got a major global shock from the White House. The timing of President Trump’s tariff announcement was not a surprise, but it was worse than anyone expected. Although we have more questions than answers, we’ll walk through what these developments could mean for economic and market conditions ahead.

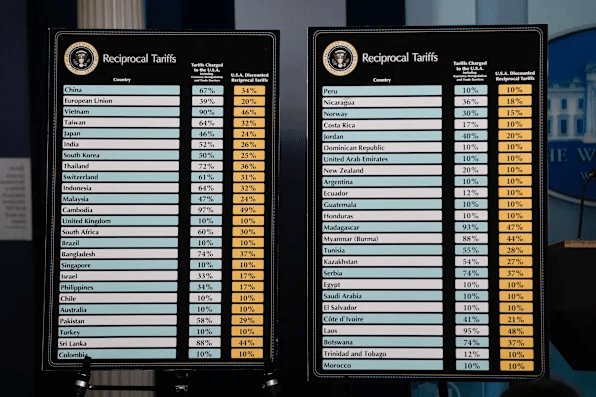

Reciprocal Tariffs

Tariffs 101

We’ll start by reviewing the basics of what tariffs are and how they’re supposed to work. A tariff is basically a tax on imports. They’re supposed to generate revenue for the government and influence domestic consumption behavior.

For example, if tariffs make imported goods more expensive, then Americans may switch to domestically produced goods as substitutes. Theoretically, this should support domestic industry and shield it from international competition. This approach to trade policy is aptly called “protectionism” (versus free trade).

Whether you love or hate the current administration, there are rational arguments for protectionism. The U.S. has a bad habit of running large trade deficits (import more than we export). Besides fiscal problems, that also creates national security concerns because dependence on imports can lead to vulnerabilities.

A central theme of President Trump’s “MAGA” approach is to bring outsourced manufacturing and jobs back to America. As such, “re-shoring” efforts, including tariffs, are likely to be an ongoing trend under the Trump administration.

Economic Impact

The reasons for protectionism are clear, but the impact such policies have on the real economy is more opaque. There is a common misunderstanding of who pays for tariffs. Contrary to what some believe, the U.S. does not collect tariffs directly from foreign companies and governments.

Instead, domestic businesses pay tariffs on foreign goods they import. Even businesses that do not engage in the importation of goods for resale can be significantly impacted, as most of them are connected to imports through their production processes. The result is rising costs for most U.S. businesses.

Some argue that US companies can avoid tariffs by simply choosing domestic inputs. That may be true, but that still leads to the same result. Companies often choose imports due to lower costs. Switching to higher-priced domestic suppliers to avoid tariffs still results in higher costs.

Ultimately, this leads to higher prices for end consumers. The inflationary impact depends on several factors. One is how high the tariff rates end up being (still subject to negotiation). And another is how much of the higher costs businesses pass-on to customers.

That last point is a double-edged sword. Of course, consumers don’t want any of the higher costs passed on. Conversely, the costs absorbed by companies lead to diminished margins, potential layoffs, and a slowdown in job creation—creating conditions for recession.

Employment is crucial because consumption is close to 70% of GDP, while net exports are only about -3%. So, while tariffs can influence WHAT consumers buy, employment (income) will determine HOW MUCH consumers buy.

Markets & Investing Impact

The above is a pessimistic perspective. And judging by the visceral market reaction, investors are expecting the worst. But the worst-case scenario isn’t guaranteed, which suggests a “sell now and ask questions later” knee-jerk reaction from investors.

For example, if counterparties can negotiate more favorable terms, then conditions could end up better than expected. In that case, this sell-off could be a classic overreaction.

Meanwhile, the US is facing this shock from a decent position. Conditions may not look as good as they did last year, but high corporate profitability, stable employment conditions, and the Fed’s ability to stimulate provide room to absorb some shock.

Both sides considered, it’s important to recognize that economic and market conditions did change for the worse in Q1 2025 versus last year. As of April 3, conditions have taken another step in that direction. Again, we don’t know for certain what will happen next, but the current trajectory is not constructive.

To put the changes, in context, the likelihood of a recession appeared high in late 2022, I estimated it at about ~80%. Of course, that was wrong, and it looked like less than ~50% by 2023, and less than ~30% by 2024.

At this point, I estimate the odds of a recession within the next year at ~50% to ~60%. With that in mind, we are ready to continue decreasing our tactical risk exposure in our Macro Allocation strategy. Specifically, we look to move from a modest underweight position down to a moderate underweight in risk assets, relative to their strategic targets.

Fortunately, up or down, markets don’t move in straight lines. That means there will be windows of opportunity to de-risk into favorable market action. We are actively watching and will act on opportunities as they arise.

We will keep you informed on what we see and do along the way. Meanwhile, feel free to contact BCM with any questions or concerns.

—

Victor K. Lai, CFA

You must be logged in to post a comment.