I wrote in March that U.S. economic and market conditions continued to improve in 2024 which was positive for risk assets. As though right on cue, the global equity markets began a month-long downturn in April. Clearly, market timing is not a forte of mine, nor has it ever been!

To be fair, I also noted that weak stock market momentum and volume suggested a short-term pullback would be reasonable if not expected. And here we are. The first notable pullback in half a year. Some investors are already bringing back whispers of a hard landing. Anything is possible, but expectations of a crash seem premature.

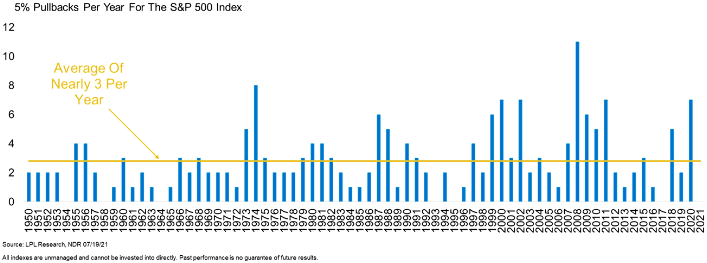

To put things into perspective, the S&P 500 is only down about ~5% from its March high. Yes, that’s more than we’ve seen in a while, but it’s not out of the ordinary. In fact, it happens about three times per year on average historically.

S&P 500 5% Drawdowns

In addition, there’s likely more room to slide because a typical stock market correction runs around -10% on average. We saw an impressive run-up in stocks since October, so an average correction doesn’t seem unreasonable. The point is that investors who are already rattled should brace themselves for more volatility.

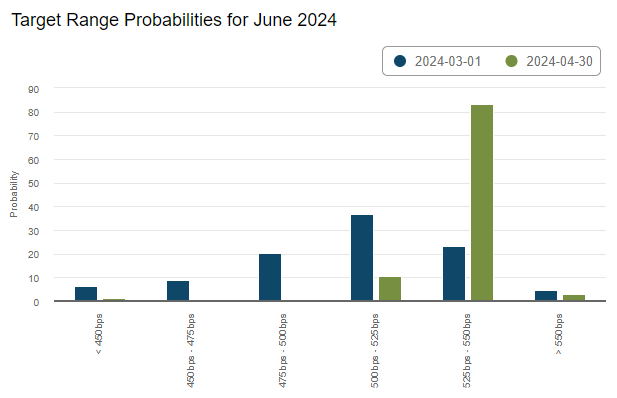

The catalyst for this sell-off appears to be sticky inflation and the Federal Reserve back peddling plans on rate cuts this year. Federal funds rate expectations swung from multiple cuts last month, to no cuts in April. That was enough to spook investors who have been anxiously anticipating lower rates.

Change in Fed Funds Rate Expectations

However, as I wrote several times, investor sentiment driven by rate cuts (or lack thereof) may be misplaced. The reality is Fed rate cuts are not a positive sign for risk assets like stocks. On the contrary, the Fed cuts rates when it sees or anticipates weakness or problems in the economy.

On the flip side, it can be implied that the Fed NOT cutting rates (or even raising them) signals a positive outlook for economic conditions. In other words, the Fed keeps rates higher when it believes the economy is doing well and can absorb more restrictive policy.

The bottom line is the “bad news” about no rate cuts may actually be good news for the economy. If so, then the current sell-off in stocks is most likely the start of a shallow correction rather than a deep crash. Let’s hope my timing is better this time around.

—

Victor K. Lai, CFA

You must be logged in to post a comment.