Before its notoriety as an international blockbuster, “Crouching Tiger, Hidden Dragon” was an ancient Chinese proverb used to describe a person, place, or thing with remarkable but hidden qualities. The current tariffs and trade war resemble an analogous situation for the US with unseen dangers.

I recently wrote about the obvious problems of an escalating trade war with tit-for-tat tariffs. In the short-run, US businesses and consumers will feel pain via rising costs and prices. Furthermore, if businesses chose to absorb rising costs (instead of passing them on), that could result in thinner profit margins, fewer jobs, and grounds for a recession.

The Trump administration acknowledges those risks, and President Trump said, “sometimes you have to take medicine to fix the problem.” He may be right, however, that prescription may also come with hidden and dangerous side effects. The most significant being the potential for global de-dollarization.

Dollarization Explained

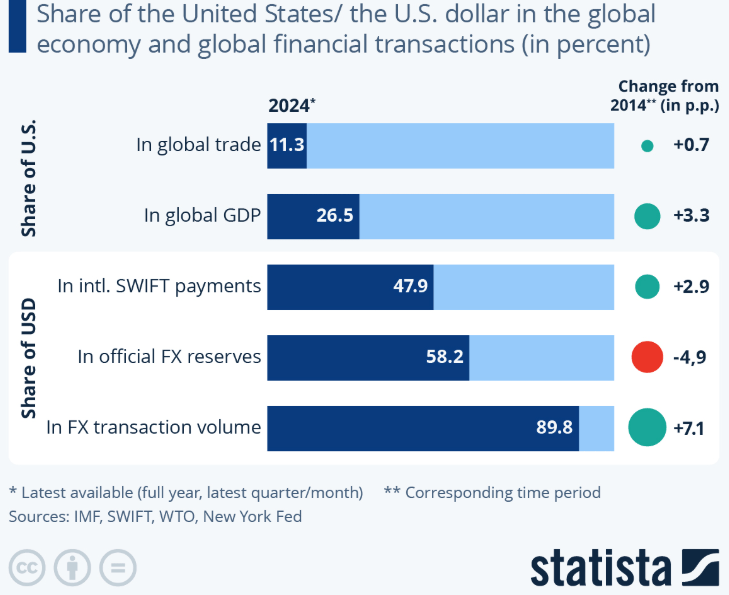

First, let’s look at what dollarization is and why it matters. The US dollar is the defacto global currency. In other words, countries around the world accept the US dollar as a legitimate form of payment. For example, almost 90% of global foreign exchange transactions are done in US dollars.

Furthermore, almost 60% of global foreign exchange reserves held by central banks and governments are also in US dollars. That happens even though there are more than 180 currencies in the world!

The willingness of foreign countries to hold US dollars reflects their confidence in America’s financial strength and credibility as a counterparty.

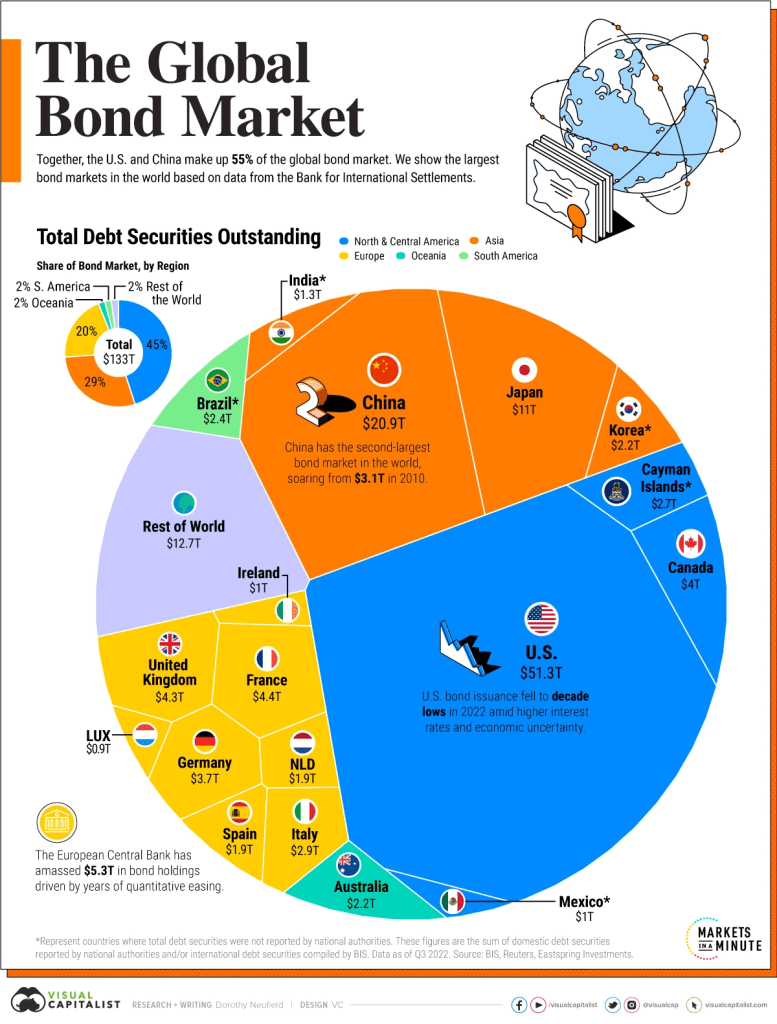

That confidence provides important benefits, including the ability to borrow large sums of money at low rates of interest. For example, the US Treasury market is the largest, deepest, and most liquid capital market in the world. This seemingly endless access to cheap money helped fund the US’s growth into a global superpower.

Crouching Tariff, Hidden Danger

So, how do tariffs disrupt this global dynamic? The rise of dollarization was enabled, in part, by a rise in free trade policies. Reducing US trade barriers made it easier for other countries to do business with America. As transaction volumes increased, so did the demand for US dollars to settle those transactions, creating a virtuous cycle.

Tariffs are a form of “protectionism” that shelters domestic industry, and represents the opposite of free trade. Imposing barriers on imports discourages foreigners from trading with the US. In a world where foreigners no longer see a benefit to trading with the US, there could be a commensurate decline in US dollar demand and a trend towards global de-dollarization.

Case in point, China, the central target of US tariffs, has been decreasing its US dollar based holdings. According to The Financial Times, China’s US Treasury holdings have fallen to the lowest levels since 2009. Meanwhile, China’s PBOC (central bank) is instructing state controlled banks to reduce US dollar purchases.

This is important because China was the largest holder of global foreign currency reserves as of year-end 2024. And until recently, it was also the largest holder of US debt via US Treasury holdings.

China’s de-dollarization could lead other countries to also “dump” their US dollars and Treasuries. In that case, the dollar would weaken against other currencies as investors sell dollars, and US Treasury prices would fall (and rates would rise) as investors sell Treasuries. That would make everything even more expensive for American businesses and consumers than tariffs do by themselves.

In addition, global de-dollarization would mean an end to low-cost financing of US debts and deficits. That would make US debts more burdensome because a higher percentage of GDP would go towards debt service, and less resources would be available for investment.

Suffice it to say, that would not be a good outcome for the US. But it could be even worse. If de-dollarization happens suddenly enough, it could cause a violent global shock and financial crisis. That’s because the US dollar is, again, the defacto global reserve currency.

Foreign countries willingly hold US dollar reserves because they trust their funds will be money good. They depend on the US dollar for stability. If they suddenly lose confidence in the dollar, we could see a catastrophic implosion as everyone rushes to the exit simultaneously.

And since the global financial markets, and even risk itself, are priced in US dollars (vis-à-vis risk-free Treasury rates), we could expect a global financial crisis unlike anything we’ve seen before as investors scramble to reprice, literally, everything.

The Dangerous Bottom Line

The threat of global de-dollarization is nothing new, it’s been economic folklore for decades. Meanwhile, China has been trying to slay the US dollar as global reserve currency long before President Trump’s “Liberation Day.”

Still, the current escalation of a global trade war breaks the seal for potential de-dollarization. At worst, it could unleash a global financial crisis and other hidden dragons.

Fortunately, that is not the most likely outcome. In all likelihood, calmer heads and better negotiations prevail that allow the world to slowly de-dollarize over time. An orderly unwind would be fine, but sudden shocks and mad dashes for the exit would be catastrophic.

We’ve already seen some constructive developments since April 3rd, including tariff pauses, exemptions by the Trump administration, and “deals” in progress.

Maybe this was the plan all along? Start with an offer so shocking that it makes negotiating something less extreme easier. Maybe we could say it was “The Art of The Deal,” and Trump’s gamesmanship on display the whole time.

Maybe, but it would still be a dangerous game to play. At BCM, we can’t predict which policies or parties prevail. Instead, we will continue to focus on how realized polices are most likely to affect economic and market conditions regardless of party affiliation.

As of early May 2025, there is still a great deal of uncertainty regarding trade policy. Will the tariff pauses be extended after 90 days? Will they be reversed through deal making? Nobody outside (and possibly even inside) the Trump administration knows for sure. That uncertainty curtails economic activity as consumers and businesses put plans on hold.

Meanwhile, one of the few things we do know is baseline tariffs of 10% went into effect on April 5th. All else equal, that’s expected to be bad for corporate profits, inflation, and economic growth. That adds to already softening US economic conditions seen in Q1.

For those reasons, we maintain our tactical underweight of risk assets in our Macro Allocation strategy. While we don’t know how economic and market conditions will change, we know that they will. As always, we continue to watch carefully and will continue to make adjustments as conditions change.

—

Victor K. Lai, CFA

You must be logged in to post a comment.