After a strong rally in 2024, global stock prices saw a pullback in February and ended Q1 with a decline of -0.8%. U.S. stocks lagged for the first time in a while, and prices were down -4.3% for the quarter. Foreign stocks stayed positive, while gold outshined and was up +17.4% year-to-date.

Global Markets Q1 2025

MACRO VIEW

In Q4 2024, I wrote investors were setting their expectations too high. The consensus expected that lower taxes, fewer regulations, and better economic conditions would feed into a risk on Trump market rally 2.0.

Yet, “better” is a relative term. Contrary to what a majority of Americans believed, U.S. economic conditions were already quite good in 2024. Expecting even “better” conditions in 2025 was setting the bar too high.

In February, markets realized the mismatch as intensifying tariffs and trade war dynamics overshadowed great expectations. In addition, weaker economic data renewed concerns about recession.

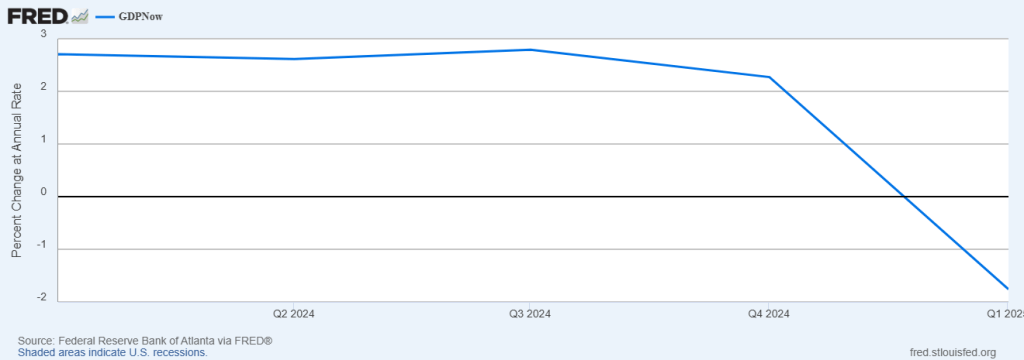

The most alarming data point was the Federal Reserve of Bank Atlanta’s GDPNow indicator. It turned negative in February for Q1, dropping as low as -2.8% (indicating economic contraction).

GDPNow Goes Negative

That and nonchalant reactions from President Trump and Treasury Secretary Bessent about a recession were enough to send risk assets into a correction. The S&P 500 gave back all of its post-Trump victory gains in just three weeks.

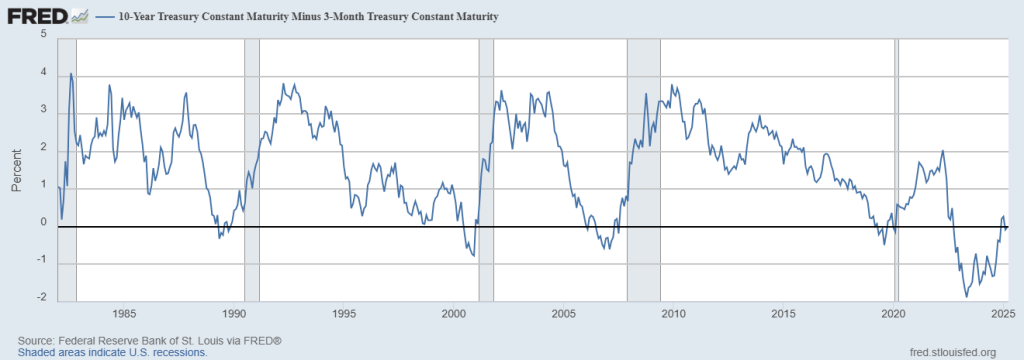

Meanwhile, other economic indicators were also flashing yellow. For example, the Treasury yield curve (3M-10Y) is back to teetering with inversion after finally un-inverting late last year. Taken alone, that’s a bad sign for economic conditions.

Yield Curve Inverts, Again

Of course, the Yield Curve can have a long lead time, and some would argue it’s now broken as a recession indicator. That’s yet to be determined. Regardless, there are no perfect indicators, and any single or even a couple could be wrong.

From a glass half full perspective, GDPNow may not be as bad as it looks. The contraction was because of an unusually negative Net Exports value. Negative Net Exports is common because the U.S. routinely runs a trade deficit.

The unusual size was from the combination of a strong U.S. dollar, softening exports, and increased imports in anticipation of tariffs. More importantly, other components of GDP (with higher correlation to recession) like consumption, business investment, and government spending, all had positive readings.

GDPNow Component Readings

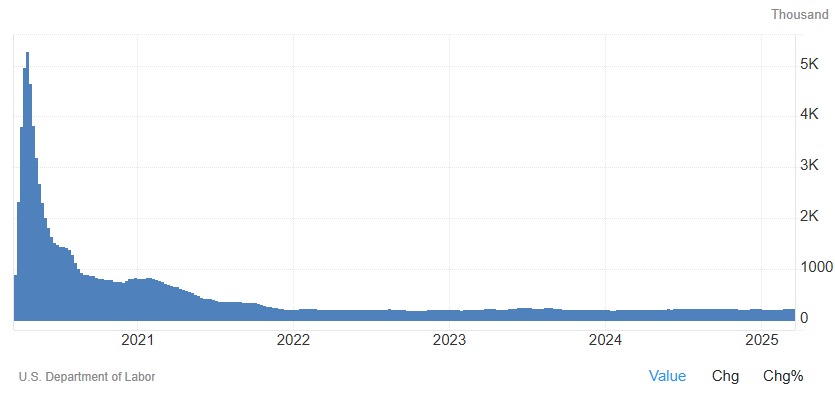

Furthermore, leading economic data, like credit spreads, corporate profits, and employment conditions, still don’t suggest an imminent recession.

High Yield Spreads Still Low

Jobless Claims Still Low

Corporate Profits Still High

All things considered, the economic data are mixed. They do not indicate an imminent recession as many are fearing. However, we recognize economic conditions changed in Q1 and look marginally worse now than they did last year.

MARKET VIEW

Market sentiment went from greedy last year to fearful in Q1. The chart below shows this based on investor sentiment.

Fear & Greed Index

Notably, the S&P 500 breached below its exponential 200-day moving average (EMA), which hasn’t happened in some time. Many view the signal as an omen, and predictions of an imminent crash quickly dominated financial media headlines.

Breaches of the 200 EMA have preceded crashes, but they also haven’t. They happen often. For example, the S&P 500 crossed below the 200 EMA 4 times in 2023 but still ended that year with a double-digit gain.

S&P 500 vs 200 EMA

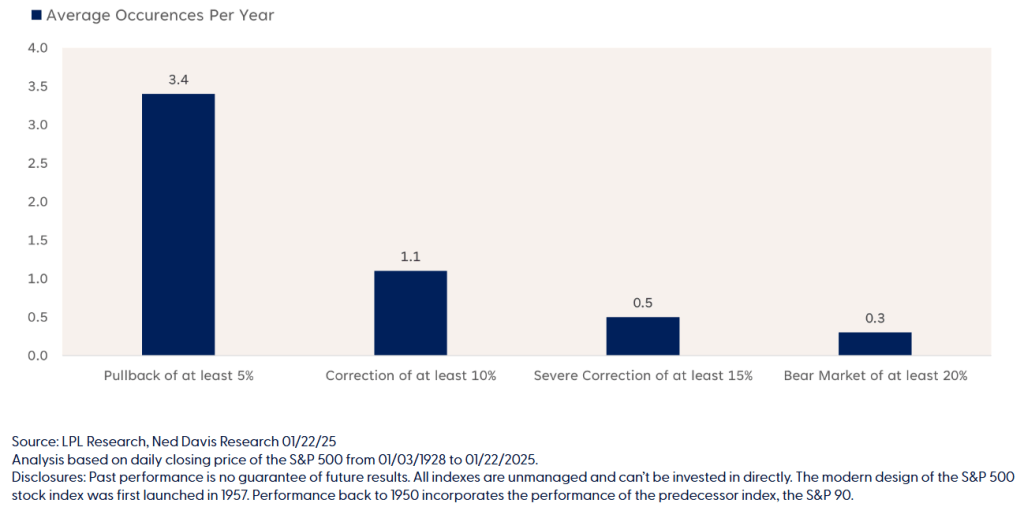

After back-to-back years of double-digit rallies, a sell-off in stocks is not unreasonable. In addition, the S&P 500 was down about -10.6% from its high in Q1, which matches the textbook definition of a typical market correction(-10%). Since 1957, S&P 500 corrections of at least -10% happened more than once a year, on average.

S&P 500 Frequency of Losses

THE BOTTOM LINE

In Q4 2024, the consensus expected an upswing. As of Q1, the consensus is expecting a downswing. If recent market action has taught us anything, it is that expectations are often unmet, and more importantly, nothing is certain.

Economic and market conditions may not suggest an imminent recession as of now, but again, nothing is certain and anything is possible. One of the only things that is clear is conditions have changed and look marginally worse now than they did last year.

Those changes and rising levels of uncertainty led us to adjust our tactical risk exposures in our Macro Allocation (MA) models during Q1. Specifically, we reduced our risk allocations below their strategic targets to modest underweights in February. Fortunately, we made the adjustments before the market correction (albeit, our timing was lucky).

That helped our results, but the adjustments were modest. We did not move to a full-blown risk-off position because now is not the time for sudden or extreme movements. Instead, we maintained broad exposure and diversification, and took an initial step towards increasing caution and recognizing that conditions marginally changed for the worse.

We will continue to make adjustments as conditions change. However, only time will tell what changes come next. Our plan, as always, is to watch carefully, wait patiently, and adjust to conditions as they change.

—

Victor K. Lai, CFA

You must be logged in to post a comment.