Last November, I wrote The Trend is Your Friend. The post summarized improvements observed in various economic and market data and also discussed the age-old market wisdom to not fight a prevailing trend. Based on what we saw, conditions supported increasing risk exposure.

That move worked in our favor because markets continued their upward trend. However, markets and trends can be fickle and are only your friends until they’re not. Just as it doesn’t pay to fight a trend, it also doesn’t pay to get complacent or overconfident. Therefore, we continue to keep a close on our friend.

Update on economic conditions

Economic conditions continue to lean on the positive side. The U.S. Composite PMI reading, which measures business activity, reclaimed the crucial 50-level last October (50 is the threshold that signals expansion). Since then, we’ve seen four consecutive readings above 50, supporting a new expansionary narrative.

U.S. Composite PMI

Of special note, the manufacturing component of the Composite PMI (or Manufacturing PMI) was the weakest part of the index over the past 24 months. Even as the services component improved, manufacturing continued to lag.

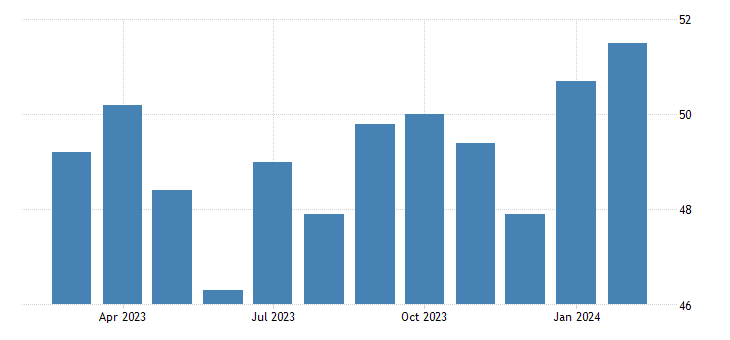

U.S. Manufacturing PMI

However, manufacturing showed a strong, surprise jump in 2024 with the U.S. Manufacturing PMI posting back-to-back readings above the 50 level. Manufacturing may only be a small portion of U.S. GDP, but it is still one of the most cyclical and sensitive parts of the economy.

Broader economic readings also show improving conditions. For example, the OECD U.S. Composite Leading Indicator posted a 10th consecutive increase in January 2024. Although it can be hard to agree on what makes a definitive trend, 10 readings in a row should satisfy most conditions.

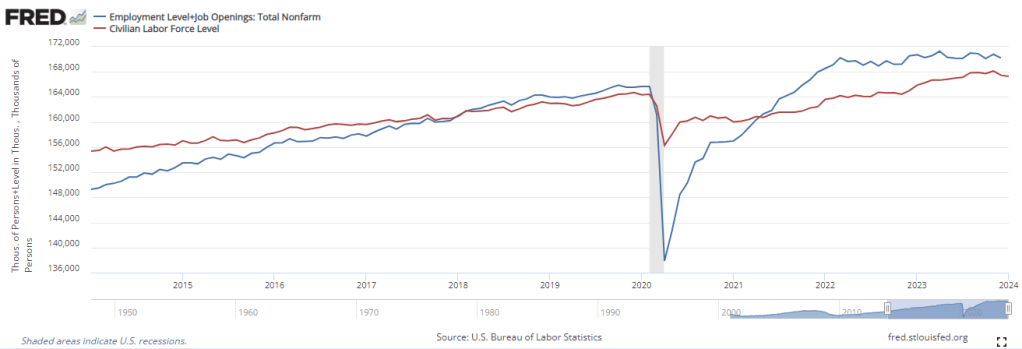

Employment conditions remain strong. Although labor supply and demand have seen a narrowing spread, the job market is still tight with job creation outpacing able and willing bodies.

Other indicators like housing are mixed. New home sales have seen a back-and-forth with a clear downturn in 2022 being supplanted by fits and starts of recoveries and pullbacks over the past year. That being said, home sales still look marginally better than they did one year ago.

The last flag standing

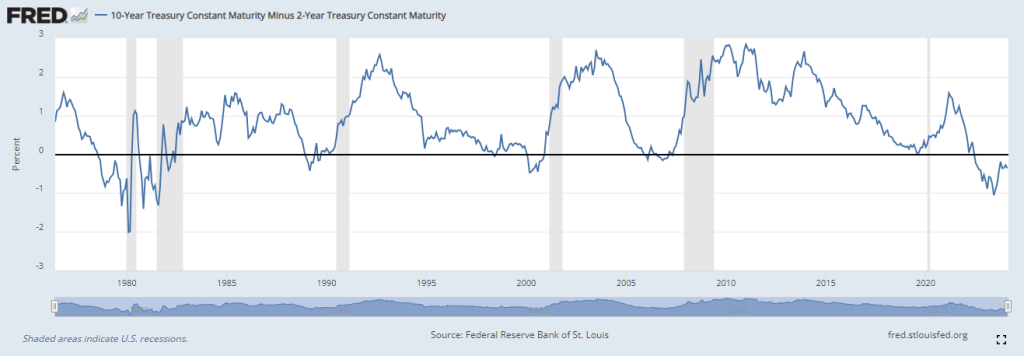

The primary, and one of the last standing, red flag is the Treasury Yield Curve (the difference between short-term term and long-term Treasury rates), which remains tenuously inverted. Before the current cycle, the yield curve had a perfect record of inverting before every U.S. recession.

Despite having been inverted since 2022, there has been no recession. Many argue the yield curve is now broken as a signal. However, I don’t think that’s true. Looking back we see recessions did follow yield curve inversions, but those recessions typically did not start until AFTER the yield curve REVERTS (or un-inverts).

Past inversions, on average, were relatively short-lived. For example, the inversions before the COVID crash, the Great Financial Crisis, and the Dot Com Bubble only lasted for a few months, and recessions followed shortly after the curves reverted. As such, we’ve been trained to expect recessions to quickly follow inversions, and the economic sirens go off the moment an inversion occurs.

However, the current inversion has gone on for well over a year, or 19-months based on the 2-10 Year Treasury curve. Since the curve still has not reverted, the signal may simply be incomplete, not broken. As I wrote before, ultimately, I think a recession was delayed rather than avoided.

The indicator to watch for reversion is the U.S. Federal Reserve’s widely anticipated “pivot.” Investors have been impatiently waiting for over a year to celebrate when the Fed will cut interest rates. Based on the Fed’s recent communications, that wait may be close to being over.

Ironically, while investors will likely celebrate with a market rally, the move could signal the beginning of the end. The Fed’s cutting of short-term rates will likely be the catalyst that causes the yield curve to finally revert. As short-term rates fall, the curve should un-invert (all else being equal) completing the ominous yield curve signal.

The bottom line

Regardless of what could happen in the quarters ahead, the current trend is positive and still intact. As long as the data support it, we will continue to take what the markets give us by maintaining neutral risk exposure.

A reversion of the Treasury Yield Curve following Fed rate cuts will be an important signal to watch as it may mark a contrarian turning point. A reverting yield curve combined with deterioration in other leading indicators (employment, housing, corporate profits, business activity, credit spreads, etc.) would signal a recession and warrant decreasing risk exposure.

For now, that is not the case. For now, the trend is still our friend, and there is no good reason to make an enemy of it.

—

Victor K. Lai, CFA

You must be logged in to post a comment.