U.S. markets celebrated President-elect Trump’s victory with a rally in risk assets. The thinking is a Trump presidency means lower taxes and fewer regulations. Both are good for business, investors feel elated and expect a repeat of 2017. But should they?

Some forgot expectations were far less festive about Trump in 2016. Many feared disorder and a market crash if Trump won. In 2016, U.S. equity futures panicked the night Trump seized victory over Clinton. At one point pre-market S&P 500 futures were down -5% and trading was halted on Nasdaq 100 futures after reaching a rare limit down.

Of course, 2016’s worst fears were not realized and U.S. stocks enjoyed two years of double-digit gains under Trump until the COVID-19 pandemic. There was a similar surprise under Biden. There was a strong consensus for a U.S. recession in 2022-2023 but the opposite happened and we had a strong, unexpected recovery.

The point is politics, life, and the markets don’t always happen how we expect them to. That matters now because there is a strong consensus expectation about improving economic and market conditions for 2025.

For example, the World Economic Forum’s most recent Chief Economists Outlook finds that 86% of economists expect strengthening U.S. growth for 2025 (in early 2023, 91% of economists incorrectly expected weakening U.S. growth).

Chief Economists Outlook

It’s not just economists. According to Gallup, the economy was the top concern for American voters. The post-election market reaction shows Americans expect the economy will improve under Trump.

But how much should we expect conditions to improve? To answer that, we need to determine what starting conditions are like. According to Pew Research, 77% of Americans did not think the U.S. economy was in good condition before the election. According to the Guardian, 56% of Americans thought the economy was in a recession!

From such a low starting point, expectations for big improvements are understandable. But those great expectations may be the problem. Contrary to popular perception, the economic data suggest the hurdles for improvement are higher than expected.

Not only is the U.S. economy not in recession, but real GDP has consistently increased post-COVID throughout the Biden administration and is currently at its highest level ever.

U.S. GDP

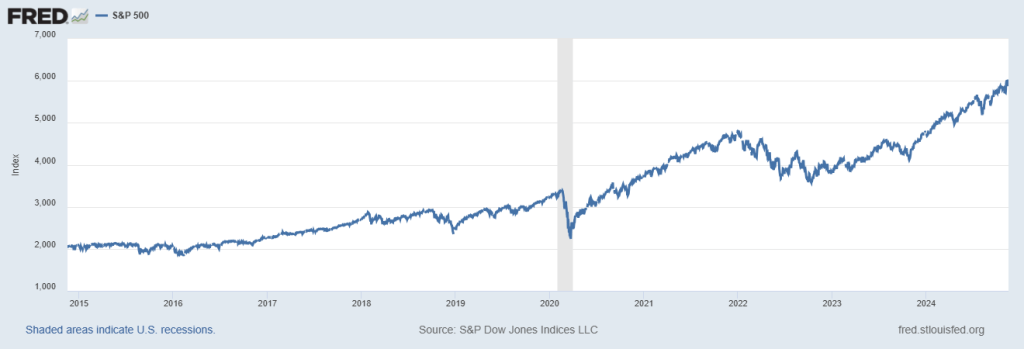

The same can be said of the U.S. stock market. The S&P 500 was setting new all-time highs well before the post-election rally.

S&P 500

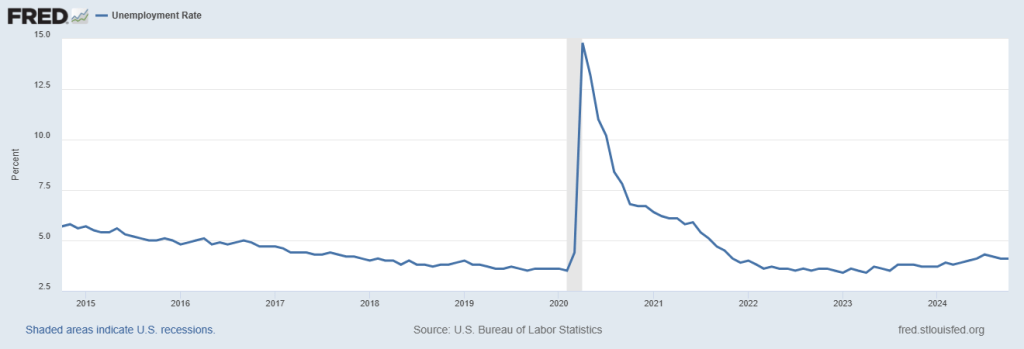

Meanwhile, employment conditions remain strong. The unemployment rate is still bouncing around the lowest levels in decades.

U.S. Unemployment

And while inflation spiked post-pandemic, it was successfully lowered over the past two years and is back near the Federal Reserve’s long-term target.

U.S. Inflation

By relevant, factual measures, U.S. economic conditions look quite good, or at least not as bad as people think. I don’t know why the common perspective diverges from the data. But I think inflation, however transient, left a lasting, negative impression on the American psyche.

Anyone who bought groceries or ate out at a restaurant in the last two years suffered a tangible consequence of inflation. People felt some type of way regardless of what economic data suggested. Unfortunately for President Biden and Vice President Harris, feelings are difficult to overcome.

Right or wrong, “perception is reality” to many people. The perception of a bad economy and the expectation of great things to come is leading to overconfidence in markets and many investors going “all-in” on risk assets based on strong feelings.

At BCM we are not doing that. Not because we are pessimistic about America. On the contrary, we know the U.S. has not been in recession and has been doing quite well. We also recognize there is little room for disappointment when market prices and valuations are at all-time highs, and the consensus is piling into risk assets speculating on what they believe must happen next year.

All things considered, current economic and market conditions also do not justify an underweight of risk assets. Therefore, we maintain our current risk positions near their strategic targets. This will change, but most likely not until we get a better idea of which campaign promises will materialize next year.

Until then, it’s a matter of maintaining discipline and patience while managing expectations and feelings (which is the most difficult of all).

—

Victor K. Lai, CFA

You must be logged in to post a comment.