2023 ended up being a great year for the financial markets. Equity markets are up double digits, crypto is again shooting for the moon, and even gold and U.S. bonds are up for the year. But it also proved to be challenging for investors, both novice and professional alike.

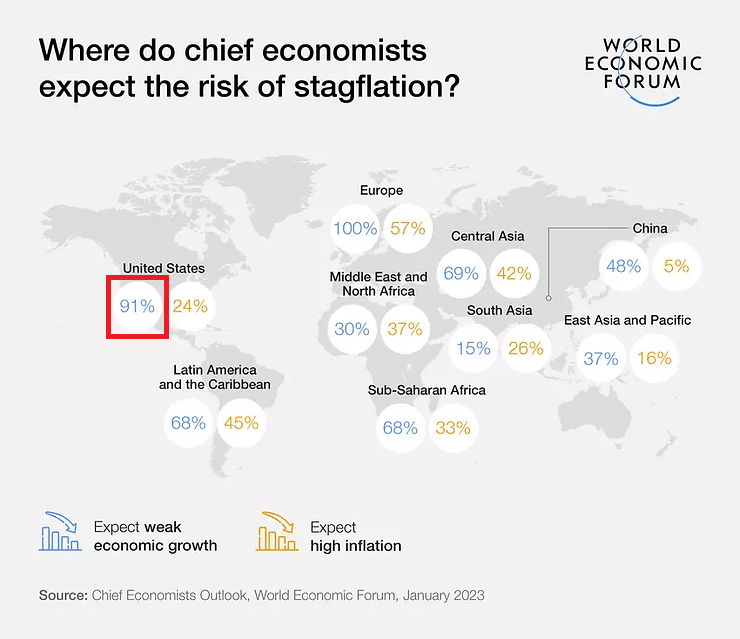

For example, at the beginning of 2023 chief economists at financial institutions like banks, investment firms, and government entities were in a strong consensus about what would happen during the year. According to the World Economic Forum’s Chief Economists Outlook from Q1 2023, 91% of economists expected growth to weaken in the U.S. during the year.

Q1 2023 Chief Economists Outlook

One of the most extreme calls was from the team at Bloomberg Economics, which predicted a 100% chance of U.S. recession in 2023.

In the defense of economists, hindsight is 20/20 while crystal balls are always hazy. I may not be an economist but I follow and use economic reports. Unfortunately, I was also wrong about an imminent recession in 2023.

I cannot speak for economists, but my error was assuming employment conditions would deteriorate in 2023 and lead to an inevitable recession. Of course, that did not happen, and I have been writing about that in this blog as it unfolded this year. I will elaborate on lessons learned in BCM’s upcoming annual letter.

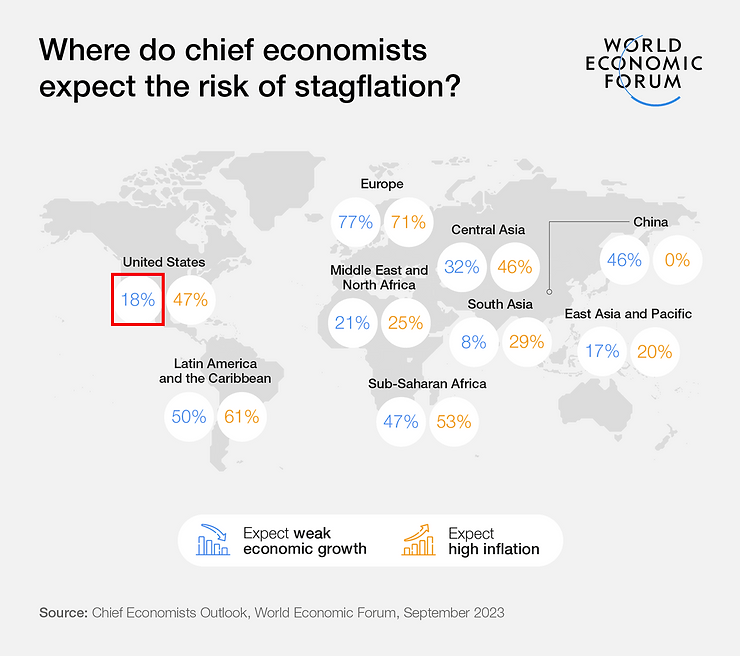

For now, let’s just say that it’s important to recognize and learn from mistakes. The world’s preeminent economists seem to have recognized theirs’. According to the most recent Chief Economists Outlook, only 18% of economists expect U.S. growth to weaken in 2024. In other words, 82% expect growth will be stronger. The consensus completely flipped by 180 degrees!

Q4 2023 Chief Economists Outlook

What does that mean? If 2023 was a precedent, it means pretty much nothing. The reality is nobody really knows what will happen next, not even financial rocket scientist Ph.D.s with 100% confidence predictions, and certainly not me.

I don’t know if a recession is off the table in 2024, but I will say that economic and market conditions look better now than they did at year-end 2022. I thought the odds of recession were around ~80% heading into 2023, and I think they are around ~50% heading into 2024.

Economic indicators are mixed, not uniformly good or bad, and could turn either way. These conditions make the economy more vulnerable to unexpected shocks like geopolitical conflicts, natural disasters, financial crashes, etc. Of course, the economy is always vulnerable to shocks, but it would be less vulnerable if conditions were very strong and robust.

However, shocks are also unpredictable so it doesn’t make sense to hide under our desks in the fetal position in anticipation of a disaster that may or may not happen. As such, we are entering 2024 by targeting a neutral weight risk position. As always, we will continue to monitor economic and market conditions and are ready to adjust risk exposure either way.

2023 was a challenging and humbling year. Despite that, it was also a year of lessons learned, improvement, and growth. As the year comes to an end, I want to thank all of our clients, family, and friends who continue to invest their trust and confidence in BCM. Thank you, and I wish you all a Happy New Year!

—

Victor K. Lai, CFA

You must be logged in to post a comment.