Last month I wrote about changes in economic conditions in 2023. The changes continue but we are seeing more dispersion. One surprise in 2023 was in U.S. housing. Despite widespread forecasts of doom and gloom, housing started the year with months of sudden and unexpected gains.

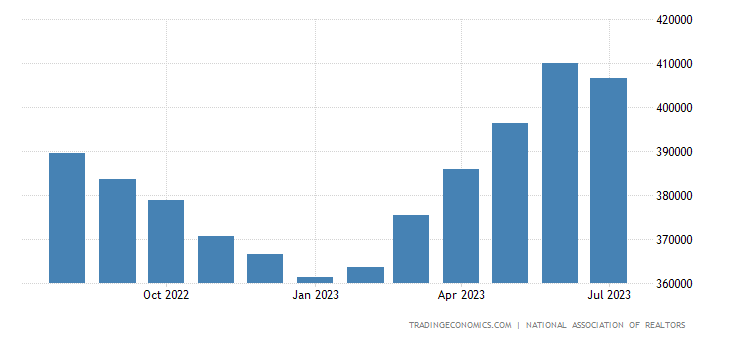

Just as people were rationalizing those gains, single-family home prices took an unexpected step down in July during what is traditionally the hot summer housing season (July data was released in August).

U.S. Single Family Home Prices

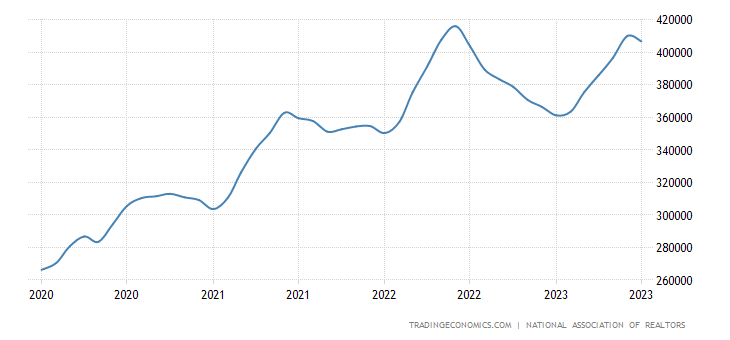

A pullback is not totally surprising because higher interest rates are supposed to cool housing prices. That being said, the pullback was modest and prices still look to be on a longer-term uptrend since COVID. Up or down, trends don’t move in straight lines so one month doesn’t make a larger trend or reversal.

U.S. Single Family Home Prices

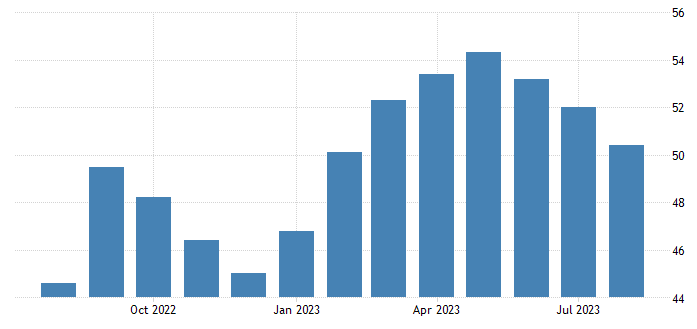

But there are other changes as well. U.S. Composite PMI data (CPMI, which measures business activity and sentiment) also started 2023 with a big surprise jump after a year and a half of persistent declines. The last eight months of declines were spent below the crucial level of 50 (readings below 50 indicate contraction) and contributed to the widespread expectations of recession last year.

However, in Q1 and Q2 of 2023, CPMI readings unexpectedly shot above 50 (readings above 50 indicate expansion). The upswing happened with considerable momentum and the expectation was for continued gains, leading many economists to reverse their calls on recession.

U.S. Composite PMI

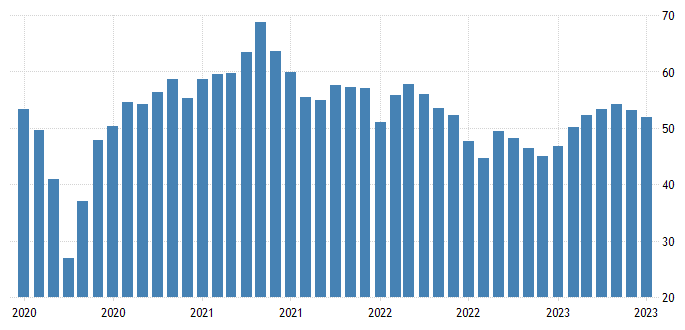

Ironically, CPMI readings unexpectedly turned down just as economic opinions were turning up. The most recent CPMI reading in August fell more than expected, down to 50.4. Again, one month does not make a trend, but August marked a third consecutive decline and brought CPMI back to flirting with contraction near the 50 level. Unlike with housing, a bigger-picture perspective shows the CPMI looks to be continuing on a longer-term downtrend that began in 2021.

U.S. Composite PMI

And of course, there are the markets. As if right on cue, the S&P 500 turned down in August, giving back about -5% of its year-to-date return. That still leaves stocks with a healthy double-digit gain, but the coordinated timing of all these changes raises eyebrows over whether this is the start of a larger move.

As you already know, the answer is we don’t know and we can’t know for certain. Despite the changes, what we do know is that, on the margin, economic conditions still look better now than they did before. That is, despite the latest pullbacks in housing, CPMI, and stocks, all are still higher today than where they were a year ago.

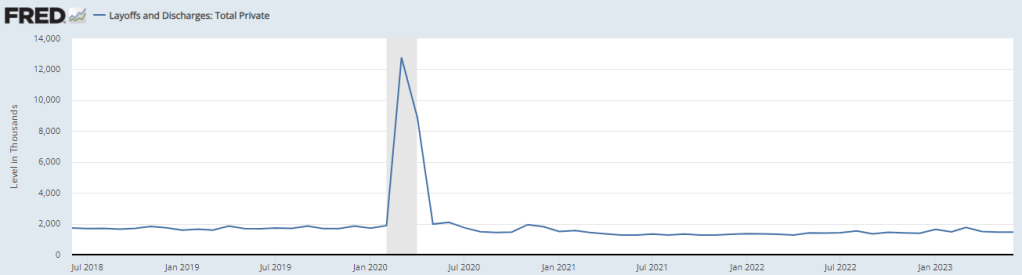

In addition, as I have written for the past year, the all-important economic pillar of employment remains standing in the U.S.. Despite layoff scares in the technology sector, overall layoffs and discharges remain relatively low.

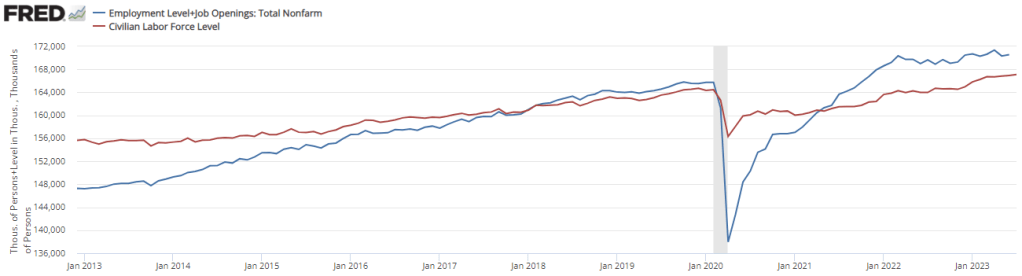

U.S. labor demand continues to outpace supply. As long as that is true, consumers have the wherewithal to earn and consume, making it difficult for a recession to surface.

In summary, we are seeing more dispersion in economic data after decided swings one way and the other in the past year. In Q4 2022 data pointed towards near certain contraction. By Q2 2023 data swung towards accelerating expansion. As of now, we’re somewhere in the middle.

As such, we maintain a modest underweight of risk assets. If economic and market conditions continue to improve, then we will continue to increase our risk allocation. At the same time, should conditions deteriorate, we are willing and ready to move in the other direction.

We are not beholden to a bullish or bearish narrative. Instead, we understand that conditions change. What happens to markets depends on what changes may come, which only time and data will tell. As always, we are waiting and watching intently.

—

Victor K Lai, CFA

You must be logged in to post a comment.