2025 is winding up to be another great year for financial markets. Global stock market prices are on pace to return more than +21% for the year. Although U.S. stocks didn’t take the lead in 2025, they are still up by double digits. They also set an unsettling new record.

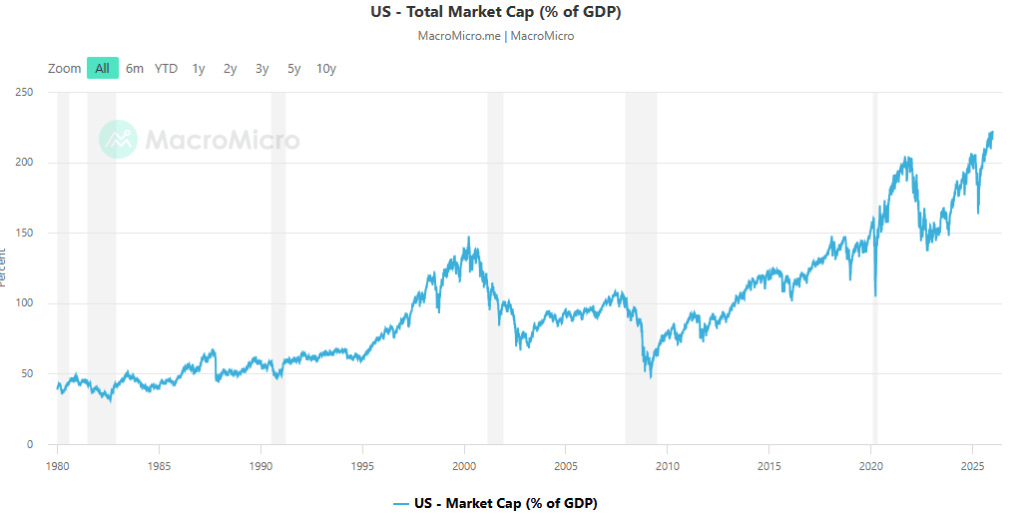

By at least one measure, the U.S. stock market reached its highest valuation level ever. The chart below shows the Market Cap to GDP ratio (aka the “Buffett Indicator”). This ratio is calculated as the total value of the stock market divided by the current value of annual GDP (MC/GDP).

The higher MC/GDP is, the more expensive stocks are (and vice versa). The long-term average level of MC/GDP is somewhere around 0.8. Based on long-term trend, normal expectations would put it somewhere around 1.0. But currently, MC/GDP is over 2.3. That’s not just high, that’s over two standard deviations above trend.

MC/GDP has blown past previous highs set during the Great Financial Crisis and even the Dot Com Bubble. That’s no easy feat because the Dot Com peak was previously seen as the standard for extraordinary excess.

Of course, some say things are different this time. AI is different, it’s the biggest technological breakthrough of all time. Strange, people said that about the internet, but that didn’t save that boom from bust. The stories may change but human nature, fear and greed, panic and exuberance, stay consistent over time.

As this cycle unravels, there are lessons to be learned from the past. When markets are rallying, it’s convenient to expect the good times will continue forever. Investing becomes “easy,” and it seems we simply cannot lose. But now is not the time to get overzealous or entitled. What the market gives, it can quickly take away.

In the spirit of the Holidays, now is the time to be grateful, humble, and increasingly careful. Enjoy the ride while it lasts, and remember it’s unlikely this cycle will end much differently from those before it.

—

Victor K. Lai, CFA

You must be logged in to post a comment.