People who spend enough time in and around the financial markets learn important (and often painful) lessons. One is that market history doesn’t necessarily repeat itself, but rhymes a lot!

Something that sounds familiar right now is the frenzy surrounding Artificial Intelligence (AI). Investors are all aboard the hype train. Just look at the AI poster child, Nvidia, its stock is up over 200% in the past 12 months!

NVDA Stock Price

NVDA bulls have their reasons. NVDA’s products are at the foundation of an exploding AI development race. Meanwhile, developers can’t build fast enough to keep up with AI’s expanding potential. It promises to be revolutionary, a technology unlike anything before it.

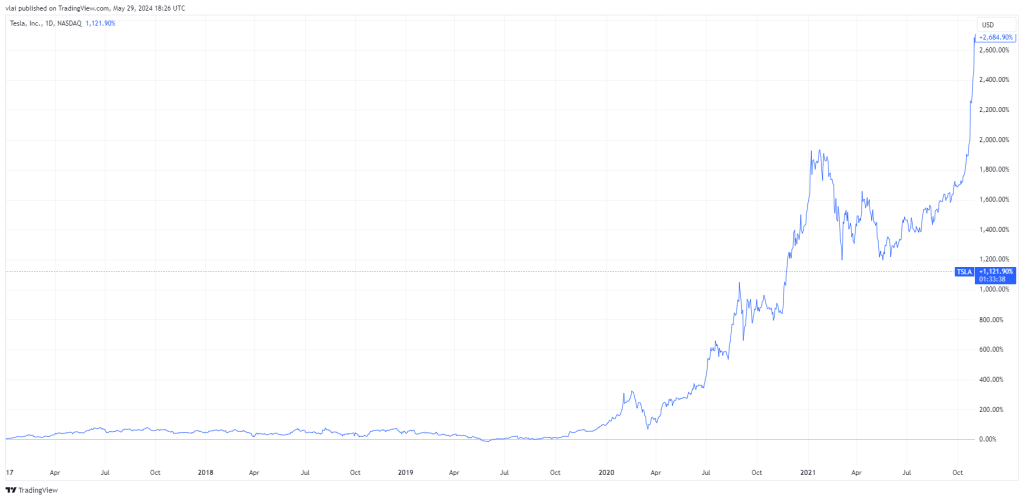

But we don’t need to rewind very far back to hear familiar tunes about another innovative technology — electric vehicles (EVs) and a revolution for the automotive industry. The parabolic charts look similar too. The EV poster child, Tesla, shot up by 20x from 2020 to 2021 (something I referred to as “irrational exuberance” at the time).

TSLA Stock Price

The Tesla story is still being written, but to the company’s credit, it has already succeeded and proved naysayers wrong. Not long ago most legacy automakers dismissed EVs, Tesla, and Elon Musk as insignificant threats to the auto industry. Also not too long ago, Tesla found itself near the brink of insolvency and barely avoided bankruptcy.

But since then, Tesla has brought EVs to the mainstream, is dominating the EV market, has one of the best-selling cars in the world, and has every legacy automaker scrambling to catch up. Despite its clear success, TSLA stock is still down close to -60% from its 2021 high.

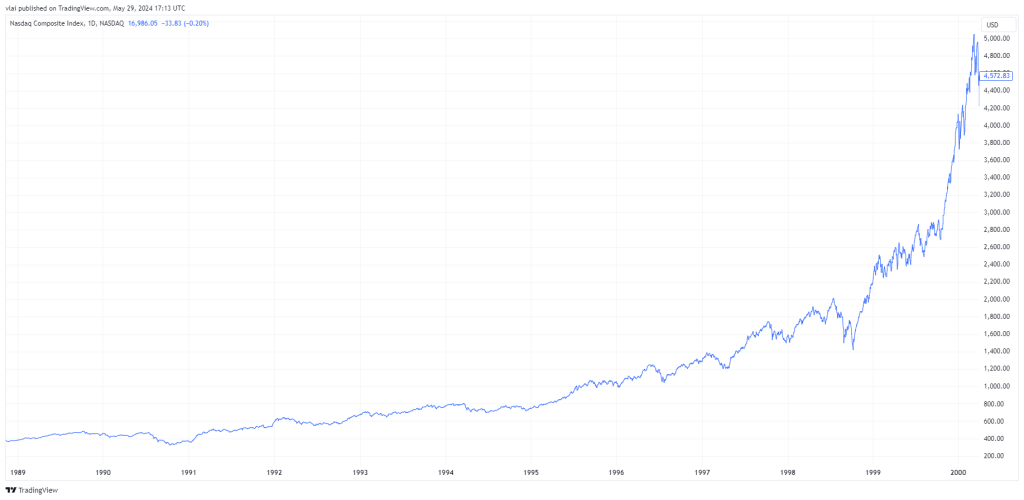

Again, there are more chapters to come in the Tesla saga, so maybe a better example is the full story of the 1990s dot-com tech boom. Back then, the frenzy around the internet sounded a lot like what people say about AI today (nod to Richard Bernstein for pointing this out). The promise, the potential, the revolution! And again, there’s that familiar vertical chart. The NASDAQ Composite (a proxy for tech stocks) shot up a staggering 100x from 1990 to 2000!

NASDAQ Composite Index

That hype train went the distance because the internet increased efficiency, and productivity, revolutionizing many aspects of modern life (mostly for the better). Yet, tech stocks still plummeted in value in the decade following 2000.

In fact, 10 years after its 2000 highs, the NASDAQ was still down by more than -50% from its peak, and many tech investors still sat on substantial losses (some total and permanent). Again, this happened even though the internet delivered its promises and proved a smashing success.

Ironically, the best-performing US equity sector in the decade following 2000 had little to do with technology, innovation, or revolutions. It wasn’t new or shiny, it was the old and boring energy sector. Dirty drills digging up smelly oil and gas. Few if any investors in 1999 predicted energy stocks would outperform tech over the following decade.

Energy Sector vs NASDAQ Composite

Maybe this time is different. Maybe NVDA will go to the moon and never come back. Maybe AI elevates humanity to a new age of enlightenment. Or perhaps it spawns “Skynet” and “Terminators” to end mankind. Nobody really knows.

That brings us to one more important market lesson. That is we never really know what the markets will do next. Regardless of what becomes of AI, the market will most likely do what most people least expect, and cause the maximum amount of pain possible in the process (heads-up to all those on the crowded AI train).

Why? Spend enough time in and around the markets and you learn there doesn’t need to be a rhyme or reason.

—

Victor K. Lai, CFA

You must be logged in to post a comment.