The U.S. economy continues to defy what has been one of the most anticipated recessions in history. Heading into 2023 the economics team at Bloomberg saw the odds of a U.S. recession at 100%.

They weren’t alone. Economists at The Conference Board, the Organization of Economic Cooperation and Development, and the Center For Economic Business and Research, all expected economic contraction in 2023.

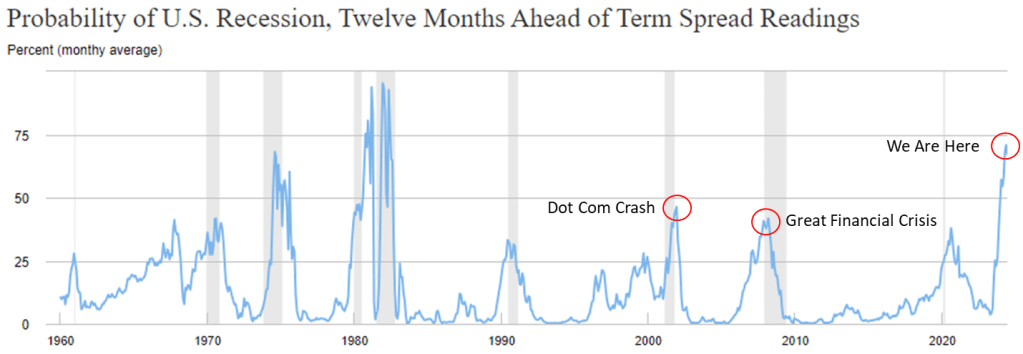

Even the NY Federal Reserve’s recession probability model signaled a recession could happen as early as 2022. Earlier this year the NY Fed model reached the highest recession probability levels in five decades.

Historically, anytime the model rose above 30%, a recession followed within 12 months. The model reached 32% before the dot-com crash and 41% before the financial crisis. It started near 60% in 2023. This is shown in the table below (grey bars represent recessions).

And yet, there has been no post-COVID recession and the likelihood of one appears to be fading. Heading into 2023 my expectation for a recession during the year was high (about ~80%) based on many of the same indicators observed by economists referenced above.

But as of now, my expectation is much lower (maybe ~40%). The explanation has been and continues to be strong employment. Last year I wrote employment was the last and “only pillar” holding up the U.S. economy, and a breakdown in the jobs market would almost certainly result in a recession.

Neither has happened. Despite weakness in various economic indicators, it’s difficult for a recession to form when employment is strong because consumption is the largest component of the U.S. economy. As long as Americans work and earn, they spend and consume.

Recent employment data show labor demand still outpaces supply and job market conditions are unlikely to change until that does.

If this labor trend continues it could lead to a virtuous cycle of employment and consumption which fuels further job creation. Like a flywheel gaining momentum this cycle can spin on until interrupted by an external shock.

That’s how the U.S. may continue to defy the most anticipated recession ever. We can already see this unfolding in some parts of the economy, where strong employment has not only outlasted other areas of weakness but may have also helped reverse it.

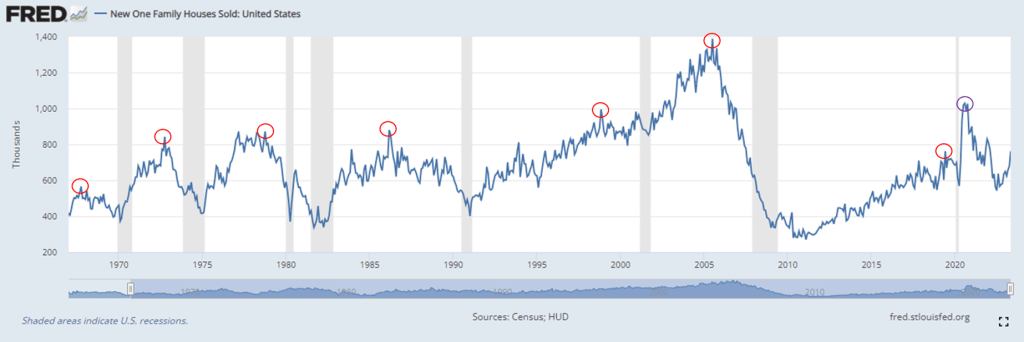

Last month I wrote about how new home sales activity is a classic cyclical indicator that declines prior to recessions. That’s because both the development and purchase of housing require substantial, long-term investment and commitment. That makes housing activity sensitive to changes in economic conditions.

The chart below shows that new home sales reached a peak (red circles) and then collapsed prior to every recession (grey bars) since 1965.

Not only that, but sales activity did not recover until after recessions started, or in some cases after they ended. The peak and decline we saw from 2021 to 2022 was an unmistakable pattern (purple circle).

Yet, despite a doubling of interest rates and housing prices still near all-time highs, home sales activity unexpectedly turned up starting in December 2022 (December data was released in January 2023). To call that a surprise is more than an understatement, it would be the first time ever with respect to the relationship between housing and the economy.

The housing sector is particularly important to the economy because of its multiplicative nature. When new home communities are built and sold, the economic effects go beyond construction and sales. Residents who live and work in the new communities bring their income, consumption, and taxes.

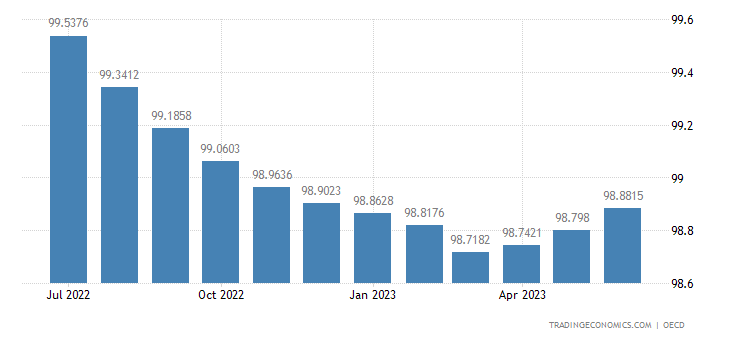

Then there are the accompanying grocery stores, retail centers, and other commercial developments, all contributing to economic activity. We can see this starting to unfold in the OECD’s U.S. Composite Leading Indicators index. After two years of declines, leading indicators finally began moving up in April of 2023, about five months after the turn-up in housing (April data was released in May 2023).

OECD CLI

Does this mean recession is off the table? No, there are still several warning signs including weakness in manufacturing, a steeply inverted Treasury yield curve, and a tightening Fed that just raised interest rates for the 11th time to the highest level in decades. Historically, these have been reliable indicators of coming recessions. I suspect a recession has been delayed rather than avoided.

Either way, the likelihood of a near-term recession is lower now than it was at the start of the year due to the improvements noted above, led by employment. In addition, persistent job growth could lead to further and broader improvements. In that case, we would continue to increase our risk allocation (regardless of suspicions or feelings) as we did in Q2.

Of course, nobody knows for certain what will happen next. Even the best economists will concede there is no such thing as “100%” certainty when it comes to forecasts. The past few years have emphatically shown us that “first-time ever” events are more common than expected, and anything is possible.

As investors, we must always be aware and willing to recognize that we could just be wrong. Just as important, we need a clear and rational process for responding when that happens. At BCM our process continues to be to monitor relevant data, evaluate available information, and make proactive adjustments when needed.

—

Victor K. Lai, CFA

You must be logged in to post a comment.