OVERVIEW

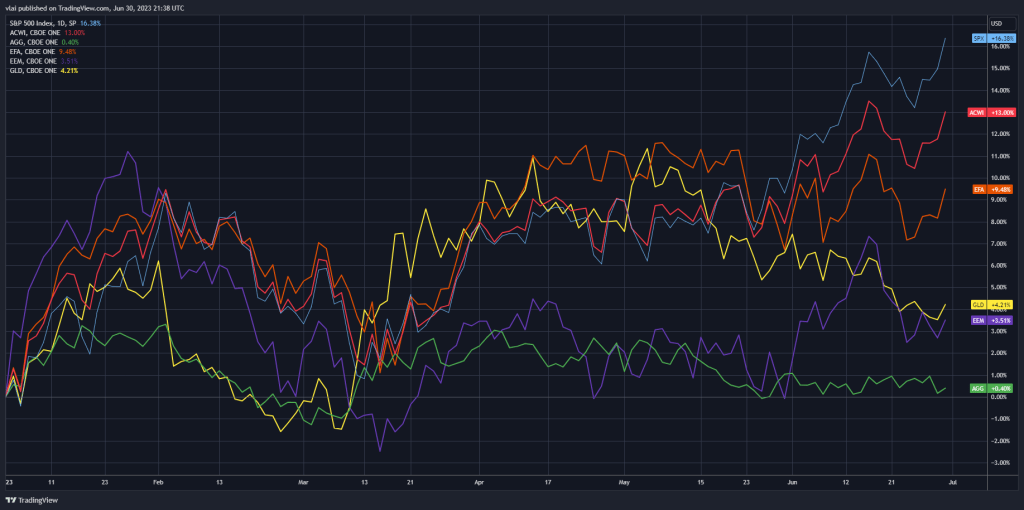

Q2 saw a continuation of the rally in global risk assets from the lows of Q4 2022. The global stock market (ACWI)was up +13% year-to-date as of June 30 while the U.S. bond market was nearly flat at +0.4% (AGG). The bulls are in the driver’s seat but bumps remain in the road ahead.

Global Markets YTD

MACRO VIEW

Employment has been and continues to be the pillar of support for the U.S. economy. The June employment report showed the U.S. added 339k non-farm jobs in May. That was well above the average forecast of 190k new jobs and continues the trend of strong job creation.

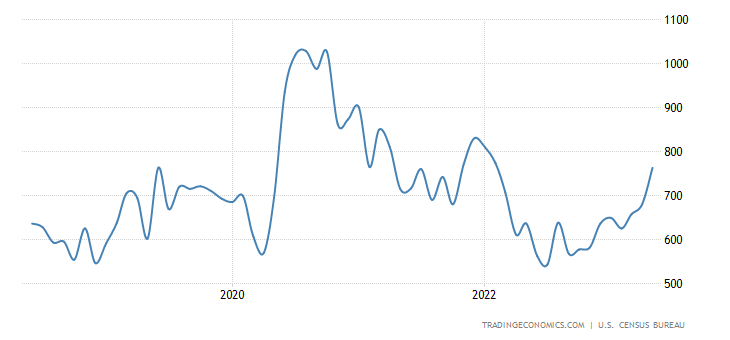

U.S. Non-Farm Payrolls

I’ve written several times that a breakdown in employment conditions could lead to an all-but-certain recession in the U.S. given the weakness in other economic data. Not only has that not happened, but employment held up so well it outlasted and possibly helped reverse the deterioration in some other economic indicators.

For example, after two years of steep drawdowns, new single-family home sales activity looks to have turned around in 2023. Historically, downturns in sales activity were reliable harbingers of coming recessions and activity did not bottom until after recessions began.

New Single-Family Home Sales

However, this turnaround happened with no recession (to date) and despite a near doubling of mortgage rates over the past year with housing prices still near all-time highs. Many people expected a real estate market meltdown the likes of the Great Financial Crisis and few expected a housing rebound to start in 2023 (I expected neither).

This unexpected turn can be explained by the relentless strength in U.S. employment conditions. The U.S. economy simply will not stop printing jobs. That fuels not only an insatiable demand for home buying but also broader consumption in general.

The question now is are we headed for the “soft landing” that seemed so elusive last year? The answer is nobody knows for sure, but the likelihood of that happening has increased. The longer job gains continue unabated, the less likely a recession will take hold.

MARKET VIEW

Judging by the financial markets, a soft landing now looks like a foregone conclusion. The S&P 500 has been in an uptrend for most of the year. It was up nearly +6% in June alone when it met the technical definition of a bull market (+20% gain from October 2022 lows).

However, a closer look reveals something less bullish. It turns out all of the S&P 500’s gains this year are concentrated in just a handful of big tech stocks like Amazon, Meta, Microsoft, Tesla, et. al. In fact, if we exclude the 7 best-performing stocks (all are big tech names), the S&P 500 Index is down -3.84% year-to-date.

Excluding the top 7 stocks altogether may be harsh, so a more balanced comparison would be to contrast the S&P 500 against an equal-weighted measure of itself. In other words, instead of giving the big tech stocks more weight (which the S&P 500 does), assign all 500 stocks an equal weight.

This creates a more balanced perspective of the market, instead of one that is lopsided by a small number of big stocks. From an equal-weighted perspective, the S&P 500 is up about +6% year to date. It’s not negative but also far from the headline of +16%.

S&P 500 vs Equal Weight

The current market rally is the most narrow one we’ve seen in decades (i.e. concentrated in few stocks). That matters because durable bull markets are typically characterized by broad market participation where widespread economic improvement lifts all boats. In that scenario, we’d expect an equal-weighted index to outperform the market.

All of this suggests the year-to-date rally in stocks could be another bear market rally. That may seem unlikely now, but consider that both the Great Financial Crisis and the dot-com bust also experienced bear market rallies of more than +20%. While it also seemed unlikely then, both rallies gave back all their gains and fell to new bear market lows.

Does that mean the market is headed to new lows? I don’t know, nobody really does. But I think it would be reckless and foolish to assume it will not or cannot happen. Based on the narrowness of market breadth and a number of economic indicators I have written about this year (including tightening Fed policy, an inverted Treasury yield curve, and declining corporate earnings growth) a healthy dose of market skepticism remains prudent.

INVESTMENT VIEW

At BCM, we remain underweight risk assets in our Macro Allocation (MA) strategy for the reasons noted above. Although positive returns are welcome following 2022, MA’s returns have also lagged behind the double-digit gains of the global stock market.

We recognize there is a risk of falling farther behind the markets by maintaining an underweight position in risk assets. However, if this is truly a new secular bull market, then it will run for years. It will also be more forgiving to be late to a secular bull market than to be early to a bear market rally.

And of course, acting out of FOMO (fear of missing out) is rarely a good long-term decision. Better to patiently observe the data than to hastily speculate on emotion.

With that in mind, we made adjustments during the past quarter as we observed economic and market conditions change. Specifically, we moved from maximum underweight in risk assets to moderate underweight. In other words, we increased our risk exposure despite maintaining an overall underweight.

We did that because economic and market data implied a recession and continued bear market were less likely than before. However, they are still relevant and significant risks and therefore we believe they are also good reasons to remain cautious.

Moving forward, if conditions continue to improve, then we will continue to increase risk exposure. And of course, the reverse is also true. Regardless of which way the market moves, I could always be wrong, and so far this year I have been. Whether I remain so time will tell. Meanwhile, I will continue to watch the data and proactively adjust as needed. I’ll keep you informed of what I’m seeing and doing along the way.

—

Victor K. Lai, CFA

You must be logged in to post a comment.