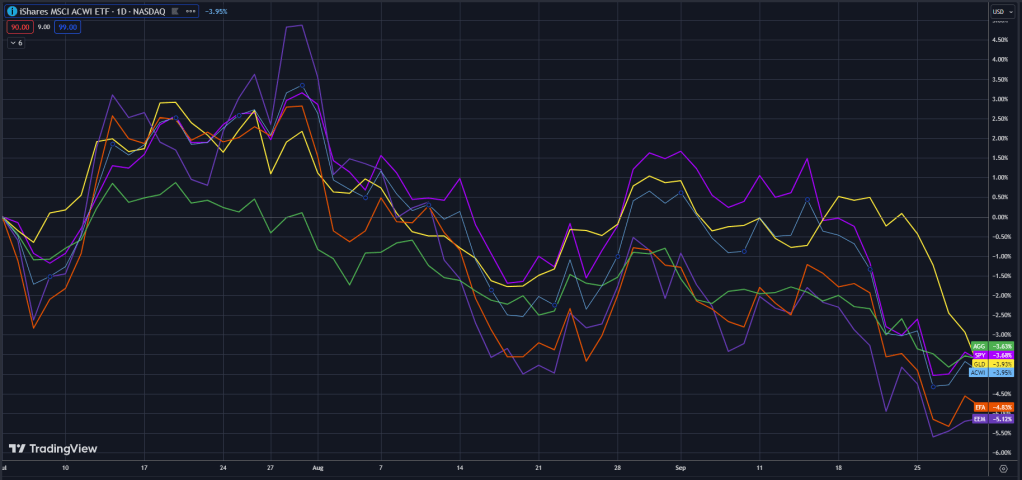

Markets moved lower in Q3 and off their highs reached in July. The global stock market was down -3.95% in the quarter (ACWI). Meanwhile, the U.S. bond market was down -3.63% over the same period (AGG). Economic indicators were mixed as the U.S. economy continued to search for a definitive direction.

Global Markets Q3 2023

MACRO VIEW

Economic conditions continue to send mixed signals heading into Q4. In the U.S., the closely watched Composite PMI (a measure of business activity) registered another decline in September, down to 50.1 and placing it a hair above the 50 level which separates expansion from contraction.

U.S. Composite PMI

The all-important U.S. consumer has also felt mixed emotions, reflected by fluctuations in the University of Michigan Consumer Sentiment Index. Sentiment is back below the crucial 70 level after a couple months of improvement (readings below 70 correlate with recessions). In fact, sentiment has remained below 70 all year (except for one month in July) and looks to be in a downtrend since the COVID pandemic.

U.S. Consumer Sentiment

While some economic indicators have weakened, the one x-factor that continues to muffle all of them is employment. So long as the jobs market remains strong, it is difficult for a recession to form because employment, consumption, and GDP are inextricably intertwined. As of now, labor demand is still outpacing supply, although the spread is narrowing.

U.S. Labor Demand & Supply

As I wrote last year, if employment breaks down while economic conditions are still weakening then we can expect a recession is nigh. Other indicators we would want to observe as confirmation include the Federal Reserve cutting interest rates and an un-inversion of the Treasury yield curve. Neither has happened, yet.

MARKET VIEW

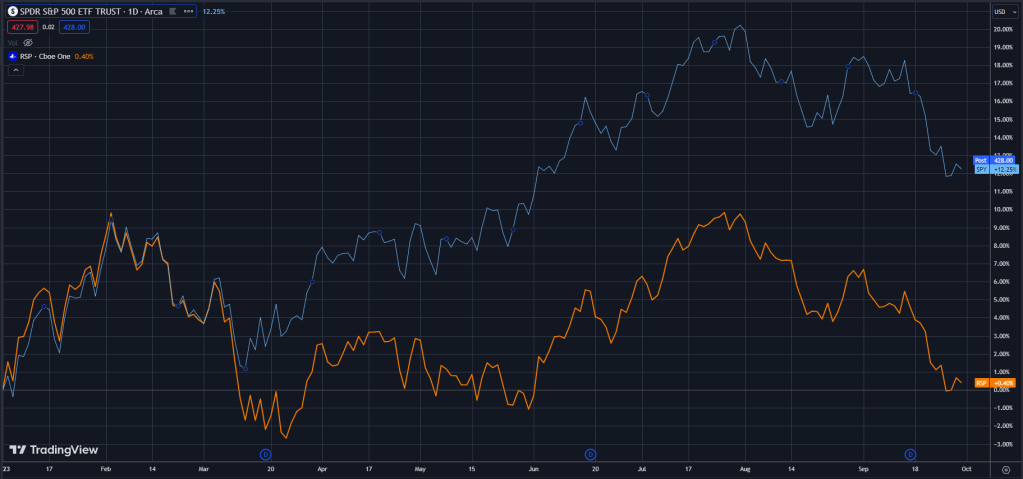

Despite the Q3 pullback, global stocks are still up +8.80% year-to-date with the U.S. stock market leading the way. However, as I pointed out last quarter, the S&P’s gains are concentrated in just a few big-tech stocks, colloquially named the “Magnificent 7” (or M7). That concentration became even more pronounced after the stock market pullback in Q3.

We can see this by comparing the standard capitalization-weighted S&P 500 index to an equal-weighted version of the index. Equal weighting reduces the skew that a small number of stocks (like the M7) has on market returns. While the S&P was up +11.7%, the equal-weighted index was nearly flat YTD (+0.40%). That means the entirety of the S&P’s 2023 gain can be attributed to the M7. And in fact, if we removed the M7 the S&P would actually be down for the year.

SPY versus Equity Weight

Another simple way to see this is to compare the S&P 500 to the Dow Jones Industrial Average, which is much less dominated by technology stocks. The Dow (DIA) was up +1.1% YTD.

Unfortunately, this is not an encouraging sign. Typically, a strong and durable bull market exhibits broad participation across sectors and stocks, indicative of a rising economic tide lifting all boats. When that is true, we expect to see an equal-weighted index outperform instead of underperform as it is now. The longer this continues, the more suspicion it raises over the durability of this rally.

Outside of U.S. stocks, other markets echo this concern. Foreign developed market stocks are only up +4.08% YTD (EFA), and emerging market stocks are negative -0.71% in 2023 (EEM), both in USD terms. Even the U.S. bond market is down -3.61% for the year (AGG).

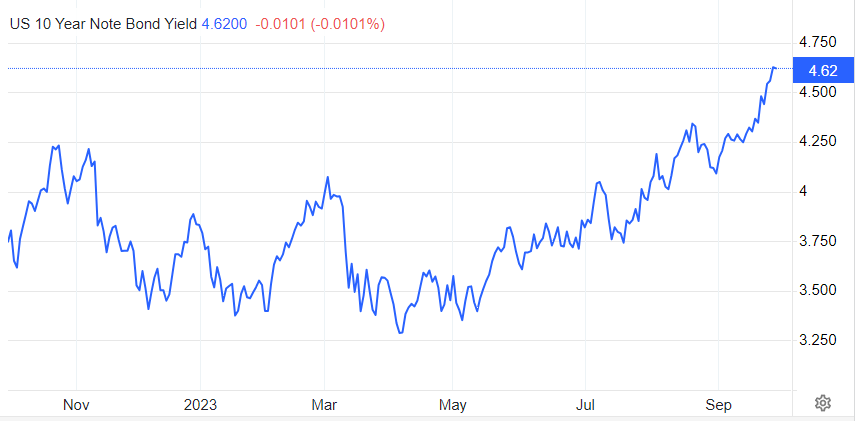

The move in bond prices was driven by a surprise spike in long-term interest rates. In August, the 10 Year Treasury yield blew past its November 2022 high, which many assumed was the cycle peak. All else equal, higher yields are a net negative for equity valuations. The takeaway is the financial markets, broadly speaking, are not as buoyant as the M7 makes them seem.

INVESTMENT VIEW

I have written many times that timing is one of the most (if not the single most) unpredictable and difficult aspects of investing. That reality has been on full display as my timing has not been good, to say the least, this year.

At BCM our Macro Allocation strategy (MA) started the year with a maximum underweight position in risk assets. That was because of what looked like a very high likelihood of a coming recession and further market downturn (at year-end 2022).

Of course, neither happened, economic conditions staged a surprise rebound in Q1 2023, and equity markets rallied. We recognized the changes and increased our risk allocation from maximum underweight to modest underweight in Q2.

Unfortunately, timing again proved its difficulty as markets were broadly negative in Q3. Despite back-to-back timing missteps, all of our MA model portfolios managed to maintain YTD gains. For what it’s worth, we also avoided the worst-case scenarios with a poignant reminder of why we do not make extreme, all-or-nothing moves at BCM.

In other words, despite our conviction of a coming recession in Q4 2022, we did not eliminate equity exposure because we recognized we could be wrong (that helped). In Q2 2023, the combination of improving economic indicators, positive market momentum, and widespread FOMO (fear of missing out) presented a seductive case for jumping “all in” to stocks with both feet.

Fortunately, we resisted that temptation (and what would have been the worst-case scenario, all in at the wrong time). Although we did increase risk exposure, we still maintained an underweight position and did not further increase risk in Q3 (that also helped).

Looking ahead, recession is still the word. In other words, whether the U.S. makes a hard or soft landing is still the most relevant, known risk for the financial markets. As of now, I see the likelihood of a U.S. recession in the coming year at ~40% to 50%. That’s up from ~40% last quarter, but still lower than the ~80% at the end of last year.

What happens with employment may very well determine which way the economy and the markets go from here. Whether up or down, we are ready to adjust our risk exposures accordingly. To that end, only time and data will tell. At BCM we are watching carefully, waiting patiently, and we will keep you informed of what we are seeing and doing along the way.

—

Victor K. Lai, CFA

You must be logged in to post a comment.